How to Enter the US Stock Market: A Comprehensive Guide

author:US stockS -Enter(1)Com(6)The(87)How(16)Market(41)Stock(145)

Embarking on the journey to enter the US stock market can be both exciting and daunting. Whether you are a seasoned investor or a beginner, understanding the steps to get started is crucial. This guide will provide you with a comprehensive overview of how to enter the US stock market, from choosing the right platform to understanding the key terms and strategies.

1. Choose a Brokerage Account

The first step in entering the US stock market is to open a brokerage account. A brokerage account allows you to buy and sell stocks, bonds, and other securities. There are numerous brokerage firms to choose from, each offering different services and fees. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

2. Research and Select a Brokerage Firm

When selecting a brokerage firm, consider factors such as fees, customer service, platform features, and the types of investments they offer. For beginners, it may be beneficial to choose a brokerage firm that offers educational resources and a user-friendly platform.

3. Fund Your Account

Once you have chosen a brokerage firm, you will need to fund your account. This can be done by transferring funds from your bank account or by using a credit card. Be sure to check the minimum deposit requirements and any fees associated with funding your account.

4. Understand the Key Terms

Before diving into the stock market, it's important to understand some key terms and concepts. Here are a few essential terms to get you started:

- Stock: A share of ownership in a company.

- Market Capitalization: The total value of a company's outstanding shares.

- Dividend: A portion of a company's profits distributed to shareholders.

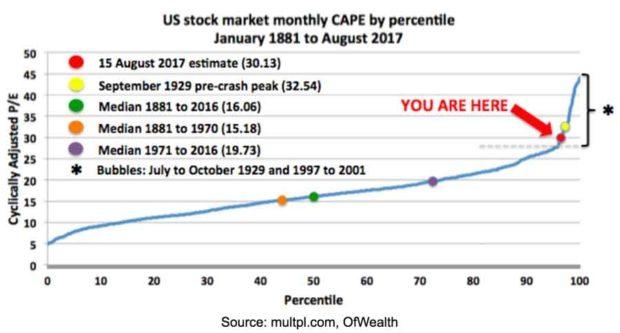

- P/E Ratio: The price-to-earnings ratio, which measures the valuation of a company's stock relative to its earnings.

5. Develop a Trading Strategy

A trading strategy is a set of rules and guidelines that you follow when buying and selling stocks. There are many different trading strategies, including:

- Day Trading: Buying and selling stocks within the same day.

- Swing Trading: Holding stocks for a few days to a few weeks.

- Long-Term Investing: Holding stocks for an extended period, often years.

It's important to choose a trading strategy that aligns with your investment goals, risk tolerance, and time commitment.

6. Stay Informed

Staying informed about the stock market is crucial for making informed investment decisions. This can be done by:

- Reading Financial News: Stay updated on market trends and company news.

- Analyzing Financial Statements: Understand a company's financial health by analyzing its financial statements.

- Using Stock Market Tools: Utilize tools such as stock screeners and technical analysis software to identify potential investment opportunities.

7. Monitor Your Investments

Once you have started trading, it's important to monitor your investments regularly. This will help you stay informed about your portfolio's performance and make adjustments as needed.

Case Study: John's Journey into the US Stock Market

John, a 30-year-old software engineer, decided to enter the US stock market to grow his savings. He opened a brokerage account with TD Ameritrade and started by investing in a mix of blue-chip stocks and ETFs. John regularly read financial news, analyzed company financial statements, and adjusted his portfolio based on market trends. After a year, John's investments had grown by 20%, and he was able to reinvest the profits to further grow his portfolio.

In conclusion, entering the US stock market requires research, planning, and discipline. By following these steps and staying informed, you can successfully navigate the stock market and achieve your investment goals.

us stock market live