Trading US Stocks in Australia: A Comprehensive Guide

author:US stockS -

Are you looking to diversify your investment portfolio by trading US stocks from Australia? If so, you've come to the right place. This comprehensive guide will walk you through everything you need to know about trading US stocks in Australia, including the benefits, the process, and some key considerations.

Understanding the Benefits

One of the primary reasons investors choose to trade US stocks from Australia is the opportunity to diversify their portfolio. The US stock market is one of the largest and most liquid in the world, offering access to a wide range of companies across various industries. By investing in US stocks, Australian investors can gain exposure to companies that may not be available on the local market.

The Process of Trading US Stocks in Australia

Trading US stocks from Australia is relatively straightforward, but there are a few key steps you need to follow:

Open a Brokerage Account: The first step is to open a brokerage account with a reputable broker that offers access to US stocks. Many Australian brokers now offer this service, so you should have no trouble finding one that meets your needs.

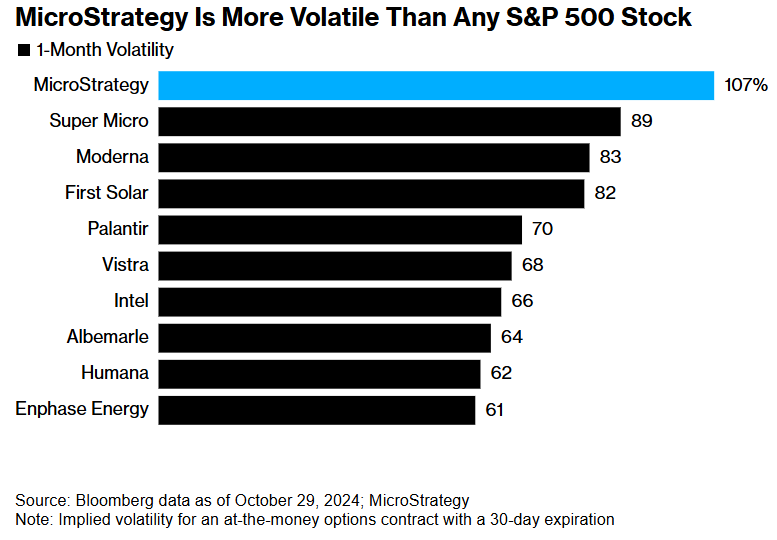

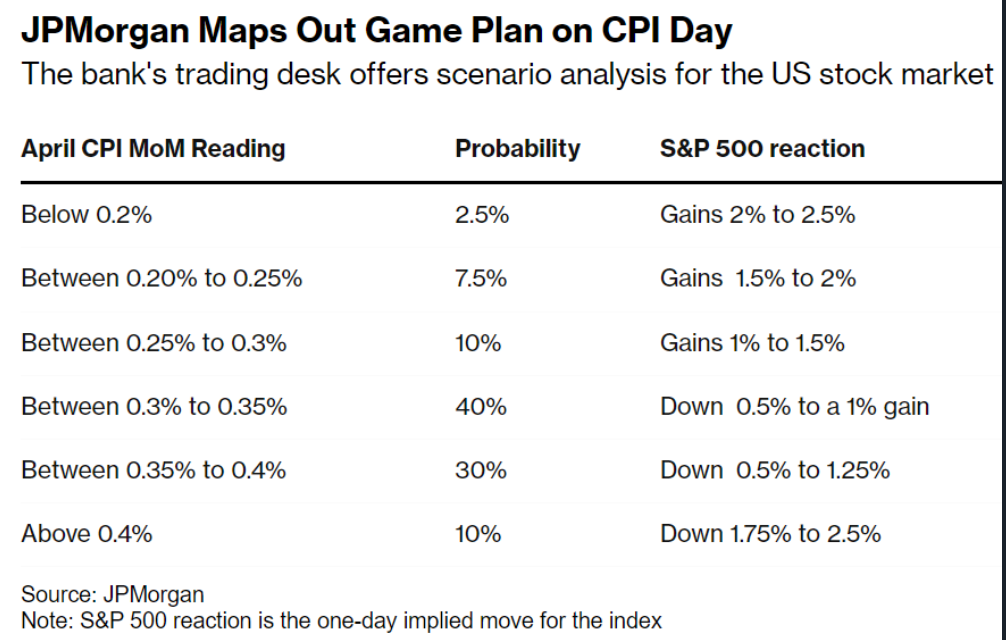

Understand the Risks: Before you start trading, it's crucial to understand the risks involved. The US stock market can be volatile, and prices can fluctuate significantly. Make sure you're comfortable with the potential risks before you invest.

Research and Analyze: Just like with any investment, it's essential to research and analyze the companies you're interested in. Look at their financial statements, industry trends, and other relevant factors to make informed decisions.

Place Your Order: Once you've done your research, you can place your order through your brokerage account. You can choose to buy stocks, sell stocks, or even sell short.

Key Considerations

When trading US stocks from Australia, there are a few key considerations to keep in mind:

Currency Conversion: Since the US stock market operates in US dollars, you'll need to consider currency conversion when buying and selling stocks. This can impact your investment returns, so it's important to understand the potential risks.

Tax Implications: It's also important to be aware of the tax implications of trading US stocks from Australia. While Australia has a double taxation agreement with the US, you may still need to pay taxes on your investment gains.

Regulatory Compliance: Make sure you're aware of the regulatory requirements for trading US stocks from Australia. This includes understanding the rules and regulations of both the Australian and US markets.

Case Study: ABC Corporation

Let's say you're interested in investing in ABC Corporation, a leading technology company based in the US. After conducting thorough research, you determine that the company is undervalued and has strong growth potential. You decide to purchase 100 shares of ABC Corporation at

Over the next year, the stock price of ABC Corporation increases to

This case study illustrates the potential benefits of trading US stocks from Australia, as well as the importance of thorough research and understanding the risks involved.

In conclusion, trading US stocks from Australia can be a valuable way to diversify your investment portfolio. By following the steps outlined in this guide and considering the key factors, you can make informed decisions and potentially achieve significant returns.

us stock market live