Pacific US Stock Assessment: A Comprehensive Guide"

author:US stockS -

The Pacific region in the United States is a hub of economic activity, particularly in the stock market. With numerous companies vying for a share of the market, it's crucial to conduct a thorough stock assessment to understand the current trends and potential investment opportunities. In this article, we'll delve into the Pacific US stock assessment, covering key aspects and providing valuable insights for investors.

Understanding the Pacific US Stock Market

The Pacific region encompasses states like California, Oregon, and Washington, which are home to several large and influential companies. This region has been a significant driver of the US economy, and its stock market reflects this dynamism. By analyzing the Pacific US stock assessment, investors can gain a clearer picture of the market's health and identify potential investment opportunities.

Key Factors Influencing the Pacific US Stock Market

Economic Growth: The economic health of the Pacific region plays a vital role in the stock market. Factors like GDP growth, employment rates, and consumer spending all contribute to the market's performance.

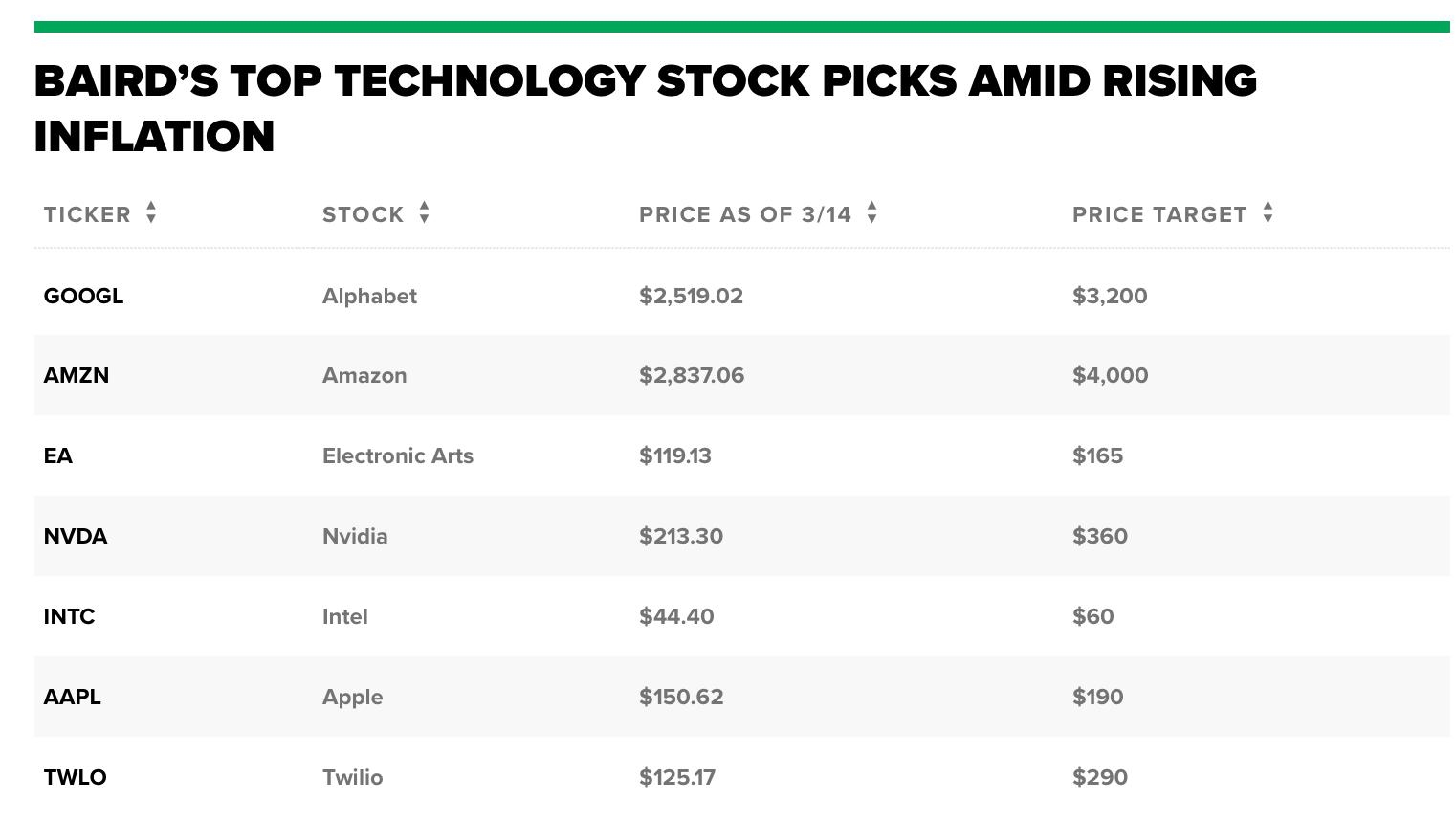

Tech Industry: The Pacific region, particularly California, is a global hub for technology companies. The success of these companies, such as Apple, Google, and Facebook, significantly impacts the region's stock market.

Energy Sector: The Pacific region is rich in natural resources, particularly oil and gas. The performance of energy companies in this region can have a substantial impact on the overall stock market.

Regulatory Changes: Changes in regulations, both federal and state, can significantly impact the stock market. For example, recent regulations on data privacy have affected tech companies in the region.

Global Economic Conditions: The Pacific US stock market is closely tied to global economic conditions. Factors like trade wars, geopolitical tensions, and currency fluctuations can have a substantial impact on the market.

How to Conduct a Stock Assessment

To conduct a stock assessment, investors should consider the following factors:

Financial Performance: Analyze the financial statements of companies in the Pacific region, including revenue, profit margins, and debt levels.

Market Trends: Identify emerging trends in the market, such as growth in certain sectors or the rise of new technologies.

Valuation: Assess the valuation of companies in the region by comparing their stock prices to their fundamentals.

Risk Factors: Identify potential risks that could impact the performance of companies in the Pacific region, such as regulatory changes or global economic conditions.

Case Studies

Let's take a look at a couple of case studies to understand how stock assessment can help investors make informed decisions:

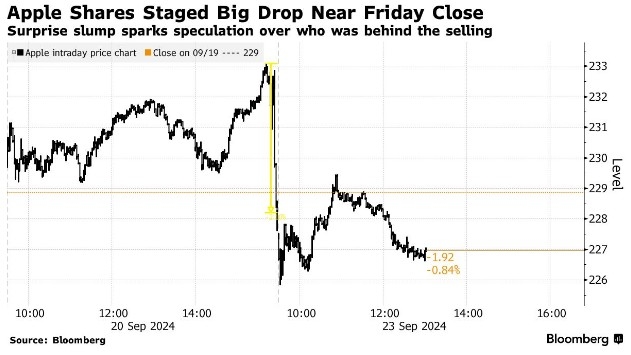

Apple: Apple's stock has been a significant performer in the Pacific region. By analyzing the company's financial performance and market trends, investors can identify opportunities to invest in the tech giant.

Chevron: As a major player in the energy sector, Chevron's stock performance is closely tied to the Pacific region's natural resources. Conducting a stock assessment can help investors gauge the potential risks and rewards associated with investing in Chevron.

In conclusion, conducting a Pacific US stock assessment is crucial for investors looking to make informed decisions. By analyzing key factors, conducting thorough research, and staying updated on market trends, investors can identify potential opportunities and manage risks effectively.

us stock market live