Understanding Margin Debt in US Stocks

author:US stockS -

In the dynamic world of the stock market, margin debt plays a crucial role in shaping investor behavior and market trends. This article delves into the concept of margin debt in US stocks, exploring its implications, risks, and the factors that influence it.

What is Margin Debt?

Margin debt refers to the practice of borrowing money from a brokerage firm to purchase stocks. Investors use their own capital as collateral for the loan, and the borrowed funds can amplify both gains and losses. This leveraged trading strategy is popular among both retail and institutional investors, as it allows them to invest more capital than they have on hand.

How Does Margin Debt Work?

When an investor buys stocks on margin, they are essentially using the brokerage firm's money to purchase additional shares. The borrowed funds are secured by the investor's existing portfolio, which serves as collateral. The interest rate on the borrowed money is typically higher than the interest rate on a standard loan, but it can still be a cost-effective way to increase investment exposure.

The Role of Margin Debt in US Stocks

1. Market Trends: Margin debt has been a key indicator of market sentiment. Historically, periods of rising margin debt have often coincided with bull markets, as investors borrow more money to take advantage of potential gains. Conversely, a decline in margin debt may signal a bearish market or an impending correction.

2. Investment Opportunities: For active traders, margin debt provides an opportunity to invest in stocks that might otherwise be out of reach. By leveraging their investments, traders can potentially achieve higher returns, though they also risk higher losses.

3. Market Volatility: Margin debt can contribute to market volatility. During periods of rapid market movements, such as during a stock market crash, margin calls may become more frequent. This can lead to forced selling of stocks, exacerbating market volatility.

The Risks of Margin Debt

While margin debt can offer attractive investment opportunities, it also comes with significant risks:

1. Margin Calls: If the value of the investor's portfolio falls below a certain threshold, the brokerage firm may demand that the investor add more collateral or pay back the loan. This can lead to forced selling of stocks, potentially at a loss.

2. High Interest Rates: The interest rates on margin loans are typically higher than those on standard loans, which can eat into investment returns.

3. Market Volatility: As mentioned earlier, margin debt can exacerbate market volatility, leading to unexpected losses.

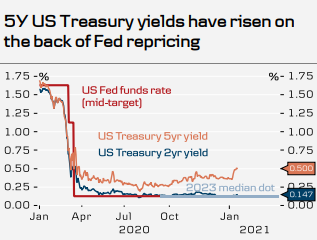

Case Study: The 2020 Stock Market Crash

The 2020 stock market crash serves as a prime example of how margin debt can contribute to market volatility. In March 2020, as the COVID-19 pandemic took hold, the stock market experienced a rapid and dramatic decline. Many investors who had leveraged their investments to purchase stocks were forced to sell at a loss, exacerbating the market downturn.

Conclusion

Margin debt is a powerful tool that can offer significant investment opportunities, but it also comes with significant risks. Understanding the implications of margin debt is crucial for investors looking to navigate the volatile world of US stocks. By carefully managing their leverage and staying informed about market trends, investors can make more informed decisions and mitigate potential risks.

us flag stock