Unlocking the Potential of US Precious Metals Stocks

author:US stockS -Precio(1)Unlocking(17)The(87)Potential(13)

In today's volatile financial market, investors are always on the lookout for stable and profitable investment opportunities. One such opportunity lies in the realm of US precious metals stocks. These stocks offer a unique blend of stability, growth potential, and diversification benefits. In this article, we'll delve into the world of US precious metals stocks, exploring their key features, growth drivers, and investment strategies.

Understanding US Precious Metals Stocks

US precious metals stocks refer to shares of companies that are involved in the exploration, mining, refining, and distribution of precious metals such as gold, silver, and platinum. These metals are highly sought after due to their limited supply, inherent value, and industrial applications.

Growth Drivers

The demand for precious metals has been on the rise due to several factors:

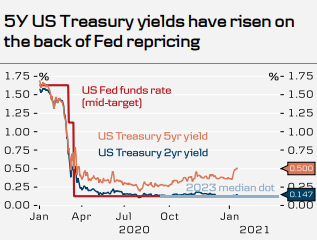

- Inflation hedge: Precious metals are often considered a hedge against inflation. As the value of the dollar declines, the value of precious metals tends to increase.

- Industrial demand: Precious metals are used in various industries, including electronics, healthcare, and automotive. The growing demand for these industries is driving the demand for precious metals.

- Investment demand: Investors are increasingly looking for alternative investment options that offer stability and growth potential. Precious metals stocks have become a popular choice among investors.

Key Features of US Precious Metals Stocks

Here are some key features of US precious metals stocks:

- Stability: These stocks are generally less volatile than stocks in other sectors, making them a good choice for risk-averse investors.

- Growth potential: The demand for precious metals is expected to continue growing, offering significant growth potential for companies in this sector.

- Diversification: Investing in precious metals stocks can help diversify your investment portfolio, reducing your exposure to market risks.

Investment Strategies

To make the most of US precious metals stocks, consider the following investment strategies:

- Research and analysis: Conduct thorough research on the companies you are considering investing in. Look for companies with strong management teams, robust financials, and a proven track record.

- Diversification: Diversify your investment portfolio by investing in stocks of different companies and metals.

- Long-term perspective: Precious metals stocks are best suited for long-term investments. Avoid getting swayed by short-term market fluctuations.

Case Study: Barrick Gold Corporation

Barrick Gold Corporation is one of the world's largest gold mining companies. The company has a strong presence in North America, South America, Africa, and Australia. Over the past few years, Barrick Gold has successfully expanded its operations and increased its production, making it a solid investment choice for precious metals investors.

In conclusion, US precious metals stocks offer a unique opportunity for investors seeking stability, growth, and diversification. By understanding the key features of these stocks and implementing a sound investment strategy, you can maximize your returns in this dynamic sector.

us flag stock