S&P vs DJIA: A Comprehensive Comparison

author:US stockS -

In the world of financial markets, the S&P 500 and the Dow Jones Industrial Average (DJIA) are two of the most widely followed indices. Both serve as benchmarks for the overall health and performance of the stock market, but they have distinct characteristics that set them apart. This article aims to provide a comprehensive comparison between the S&P 500 and the DJIA, highlighting their differences and similarities.

The S&P 500

The S&P 500, also known as the Standard & Poor's 500, is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies represent various sectors of the economy, including technology, healthcare, finance, and consumer goods. The S&P 500 is considered a broad and diversified index, providing a comprehensive view of the U.S. stock market.

Key Features of the S&P 500:

- Diversification: The S&P 500 includes companies from various sectors, offering a balanced representation of the economy.

- Market Capitalization: The index consists of companies with a market capitalization of at least $8.2 billion.

- Inclusion Criteria: Companies must have a minimum of $2 billion in revenue and be publicly listed for at least a year.

- Rebalancing: The index is rebalanced annually to ensure it reflects the evolving market conditions.

The DJIA

The DJIA, on the other hand, is a price-weighted index that tracks the performance of 30 large, publicly-traded companies in the United States. These companies are selected from various sectors, including finance, technology, and consumer goods. The DJIA is often seen as a representation of the blue-chip companies in the U.S. stock market.

Key Features of the DJIA:

- Blue-Chip Companies: The DJIA includes well-established companies with a strong track record of profitability and stability.

- Price-Weighted: The index is calculated by adding the prices of the 30 stocks and dividing by a divisor. This means that companies with higher stock prices have a greater impact on the index.

- Limited Representation: The DJIA only includes 30 companies, which limits its diversification compared to the S&P 500.

- Historical Significance: The DJIA has been around since 1896, making it one of the oldest and most recognized stock market indices.

Comparison: S&P 500 vs DJIA

While both the S&P 500 and the DJIA provide insights into the U.S. stock market, there are several key differences between them:

- Diversification: The S&P 500 is more diversified, as it includes companies from various sectors, while the DJIA is limited to 30 companies.

- Market Capitalization: The S&P 500 includes companies with a minimum market capitalization of

8.2 billion, compared to the DJIA's requirement of 10 billion for inclusion. - Performance: The S&P 500 tends to outperform the DJIA during bull markets, as it represents a broader range of companies.

- Volatility: The DJIA is more volatile due to its price-weighted nature, while the S&P 500 is generally more stable.

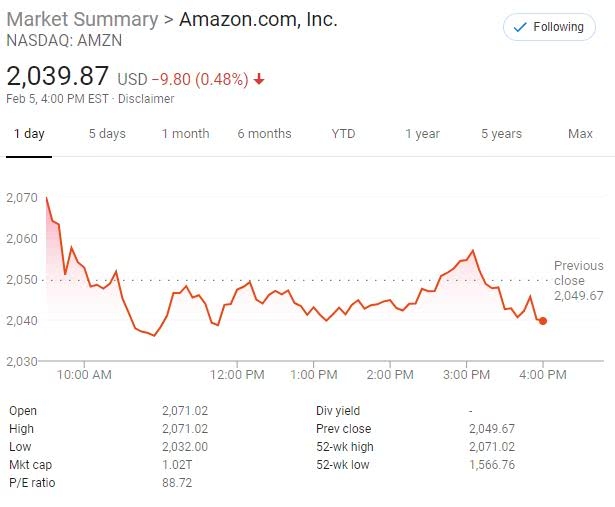

Case Study: Tech Stocks

One notable difference between the S&P 500 and the DJIA is the inclusion of tech stocks. The S&P 500 includes companies like Apple, Microsoft, and Amazon, which have significantly contributed to the index's growth over the years. In contrast, the DJIA does not include any tech stocks, as it focuses on blue-chip companies with a long-standing presence in the market.

Conclusion

In conclusion, the S&P 500 and the DJIA are two important stock market indices that serve as benchmarks for the overall market performance. While the S&P 500 is more diversified and includes a broader range of companies, the DJIA provides a representation of blue-chip companies with a strong track record of profitability. Understanding the differences between these indices can help investors make informed decisions about their investments.

new york stock exchange