Percent of US Population Owning Stocks: A Comprehensive Look"

author:US stockS -

Have you ever wondered how many Americans actually own stocks? The percentage of the US population owning stocks has seen significant fluctuations over the years, influenced by various economic factors and investment trends. In this article, we'll delve into the current statistics, analyze the factors contributing to this percentage, and provide some insightful case studies.

The Current Statistics

As of 2021, approximately 55% of Americans own stocks, either directly or through retirement accounts. This figure is a substantial increase from just a few decades ago, when the percentage was significantly lower. This upward trend can be attributed to several factors, including increased financial literacy, lower investment barriers, and the rise of automated investment platforms.

Factors Contributing to the Percentage

Increased Financial Literacy: As people become more educated about personal finance and investment options, they are more likely to invest in the stock market. This is particularly evident among younger generations, who have grown up in an era of financial literacy and digital investing platforms.

Lower Investment Barriers: The advent of low-cost online brokers and investment apps has made it easier and more affordable for individuals to invest in the stock market. Platforms like Robinhood and Betterment have democratized access to the market, allowing even those with limited financial resources to participate.

Rise of Retirement Accounts: Employer-sponsored retirement accounts like 401(k)s and individual retirement accounts (IRAs) have become increasingly popular, offering tax advantages and automatic investment options. These accounts have significantly contributed to the percentage of Americans owning stocks.

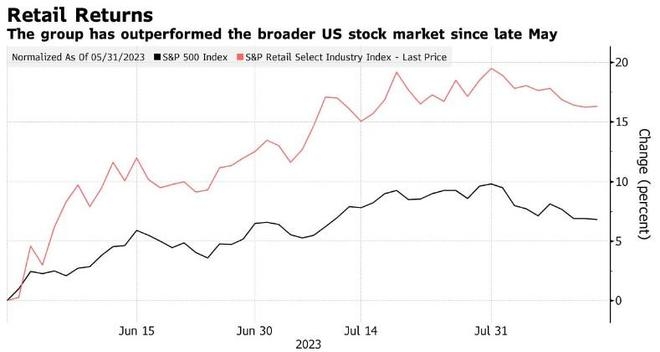

Market Performance: The stock market's strong performance over the past few years has incentivized investors to stay in or enter the market. The S&P 500, for instance, has experienced a remarkable rally, making investors more optimistic about their investments.

Case Studies

The Millennials: The millennial generation has been a significant driver behind the increase in the percentage of Americans owning stocks. Their financial literacy, coupled with a strong interest in technology and investing, has propelled them to take an active role in the stock market.

Retirement Accounts: The rise of retirement accounts like 401(k)s and IRAs has played a crucial role in increasing the percentage of Americans owning stocks. A 2019 study by the Investment Company Institute found that 41 million American workers participated in a defined contribution plan, with an average balance of $98,000.

Low-Cost Online Brokers: The emergence of low-cost online brokers has significantly contributed to the increase in the percentage of Americans owning stocks. Platforms like Robinhood and Charles Schwab have attracted millions of new investors, offering commission-free trading and easy-to-use interfaces.

Conclusion

The percentage of the US population owning stocks has been steadily increasing, driven by factors such as financial literacy, lower investment barriers, and the rise of retirement accounts. This trend is likely to continue as younger generations become more financially savvy and embrace digital investing platforms. By understanding the factors contributing to this increase, we can gain valuable insights into the evolving landscape of the stock market and personal investments.

new york stock exchange