DJIA 5 Year Graph: A Comprehensive Analysis

author:US stockS -

The Dow Jones Industrial Average (DJIA), often referred to as "The Dow," is one of the most influential stock market indices in the United States. Its performance over the past five years has been a testament to the resilience and growth potential of the American economy. In this article, we delve into the DJIA's 5-year graph, analyzing its trends, significant milestones, and potential future directions.

Understanding the DJIA

The DJIA tracks the stock prices of 30 large companies across various sectors, including finance, technology, and consumer goods. It serves as a gauge of the overall health of the U.S. stock market and is widely regarded as a benchmark for long-term investment returns.

The 5-Year Graph: A Visual Journey

The 5-year graph of the DJIA reveals a remarkable journey of growth and stability. In the following sections, we will explore the key trends and milestones observed in this period.

1. 2016 - The Year of Recovery

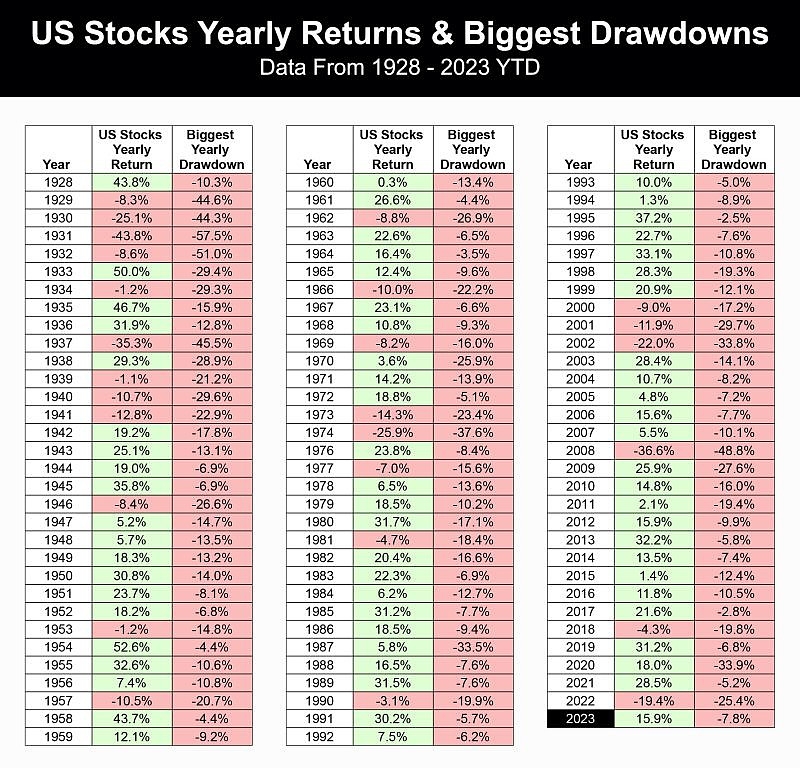

After a volatile 2015, the DJIA embarked on a robust recovery in 2016. The index gained nearly 13% over the year, driven by factors such as the Federal Reserve's cautious approach to interest rate hikes and the strong performance of tech giants like Apple and Microsoft.

2. 2017 - The Bull Market Continues

The bull market that began in 2016 continued to gain momentum in 2017. The DJIA soared by nearly 25%, propelled by strong corporate earnings and the passage of the Tax Cuts and Jobs Act, which provided significant tax relief to businesses.

3. 2018 - The Turbulent Year

2018 marked a challenging year for the DJIA, with the index experiencing its worst performance since the 2008 financial crisis. The main culprits were trade tensions between the United States and China, as well as concerns about rising interest rates and inflation.

4. 2019 - A Strong Comeback

In 2019, the DJIA staged a remarkable comeback, gaining over 28% for the year. This surge was driven by a variety of factors, including the easing of trade tensions, improved corporate earnings, and the Federal Reserve's decision to lower interest rates.

5. 2020 - The Impact of COVID-19

The outbreak of the COVID-19 pandemic in early 2020 sent shockwaves through the global economy and the stock market. The DJIA plummeted by over 30% in March, but it quickly recovered, ending the year with a modest gain of 8.4%. This resilience can be attributed to unprecedented government stimulus measures and the strong performance of certain sectors, such as technology and healthcare.

Significant Milestones

Several significant milestones were achieved during the 5-year period. Notably, the DJIA crossed the 29,000 mark in February 2020, reflecting the strong economic fundamentals of the United States.

Potential Future Directions

Looking ahead, the DJIA faces several challenges and opportunities. The ongoing trade tensions, rising interest rates, and the global economic impact of the COVID-19 pandemic are among the key factors that could influence its performance. However, with the strong economic recovery in the United States and the potential for innovation in key sectors, the DJIA remains poised for continued growth.

Conclusion

The DJIA's 5-year graph offers a compelling story of resilience, growth, and potential. By understanding the key trends and milestones observed in this period, investors can gain valuable insights into the future direction of the American stock market.

new york stock exchange