Stock Trading Between China and the US: Opportunities and Challenges

author:US stockS -

In today's globalized economy, stock trading between China and the US has become a significant aspect of international finance. This article delves into the opportunities and challenges that arise from this dynamic relationship, highlighting key factors that investors should consider.

Understanding the Market Dynamics

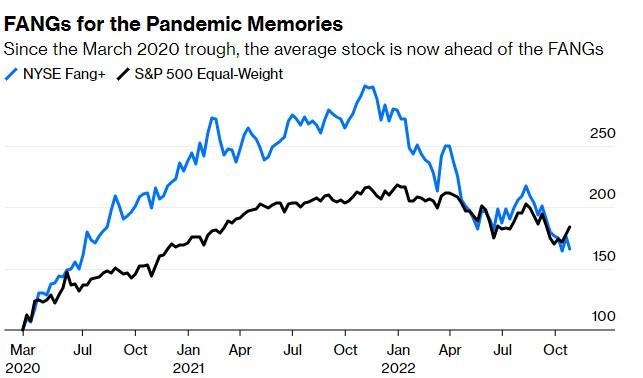

The stock market in China, known as the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), has been growing rapidly in recent years. The US stock market, represented by the New York Stock Exchange (NYSE) and the NASDAQ, is the largest and most influential in the world. The interplay between these two markets presents both opportunities and challenges for investors.

Opportunities for Investors

- Diversification: Investing in stocks from both China and the US allows investors to diversify their portfolios, reducing risk and potentially increasing returns.

- Access to Growth Markets: China's economy is one of the fastest-growing in the world, offering investors exposure to a wide range of industries and sectors.

- Technology and Innovation: Both China and the US are at the forefront of technological innovation, providing opportunities to invest in cutting-edge companies.

- Currency Fluctuations: The exchange rate between the Chinese yuan and the US dollar can create opportunities for investors to profit from currency movements.

Challenges for Investors

- Regulatory Differences: The regulatory frameworks in China and the US differ significantly, which can make it challenging for investors to navigate both markets.

- Language Barriers: Understanding the language and cultural nuances of both markets is crucial for successful investing.

- Political Risks: Political tensions between China and the US can impact stock prices and investment decisions.

- Market Volatility: Both the Chinese and US stock markets can be volatile, making it important for investors to stay informed and disciplined.

Case Studies

- Alibaba: As one of the largest e-commerce companies in the world, Alibaba has been a major success story in the Chinese stock market. Its US-listed shares on the NYSE have also performed well, offering investors exposure to both markets.

- Baidu: Baidu, China's leading search engine, has seen significant growth in both the Chinese and US markets. Its US-listed shares have provided investors with a way to invest in the Chinese technology sector.

- Tesla: Tesla, a US-based electric vehicle manufacturer, has gained a strong presence in the Chinese market. Its shares are listed on the NASDAQ, allowing US investors to invest in the company.

Conclusion

Stock trading between China and the US presents a unique opportunity for investors to diversify their portfolios and gain exposure to rapidly growing markets. However, it also comes with its own set of challenges, including regulatory differences and market volatility. By understanding these factors and staying informed, investors can make informed decisions and potentially profit from this dynamic relationship.

new york stock exchange