Can International Students Invest in US Stocks? A Comprehensive Guide

author:US stockS -

Investing in US stocks has long been a popular choice for investors worldwide, including international students. With the rise of global financial markets, many students are eager to explore investment opportunities in the United States. In this article, we will delve into the question: Can international students invest in US stocks? We will discuss the requirements, the process, and the benefits of doing so.

Eligibility and Requirements

To invest in US stocks, international students must meet certain criteria. Firstly, they must have a valid visa, such as an F-1 or J-1 visa, which allows them to study in the United States. Additionally, they need to have a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN) to open a brokerage account.

Opening a Brokerage Account

Once the eligibility criteria are met, the next step is to open a brokerage account. There are numerous online brokers available that cater to international investors, such as TD Ameritrade, E*TRADE, and Charles Schwab. These brokers offer a variety of investment options, including stocks, bonds, and mutual funds.

To open an account, students will need to provide personal information, including their full name, date of birth, address, and SSN or ITIN. They will also need to complete a questionnaire regarding their investment experience and risk tolerance.

Investment Options

International students have access to a wide range of investment options in the US stock market. Some popular choices include:

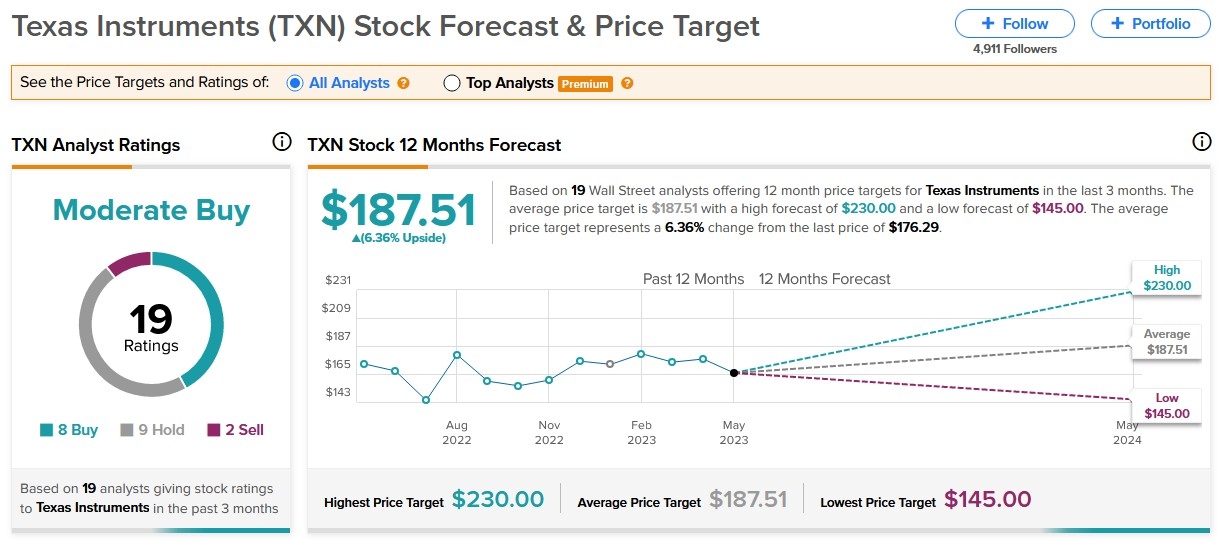

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a history of reliable performance. Examples include Apple, Microsoft, and Johnson & Johnson.

- Growth Stocks: These stocks are from companies with high growth potential. They may not have the same level of stability as blue-chip stocks but offer the potential for significant returns. Examples include Netflix and Tesla.

- Dividend Stocks: These stocks provide investors with regular dividend payments. They are often considered a safer investment option, as they offer a steady income stream. Examples include Procter & Gamble and Coca-Cola.

Benefits of Investing in US Stocks

Investing in US stocks offers several benefits for international students:

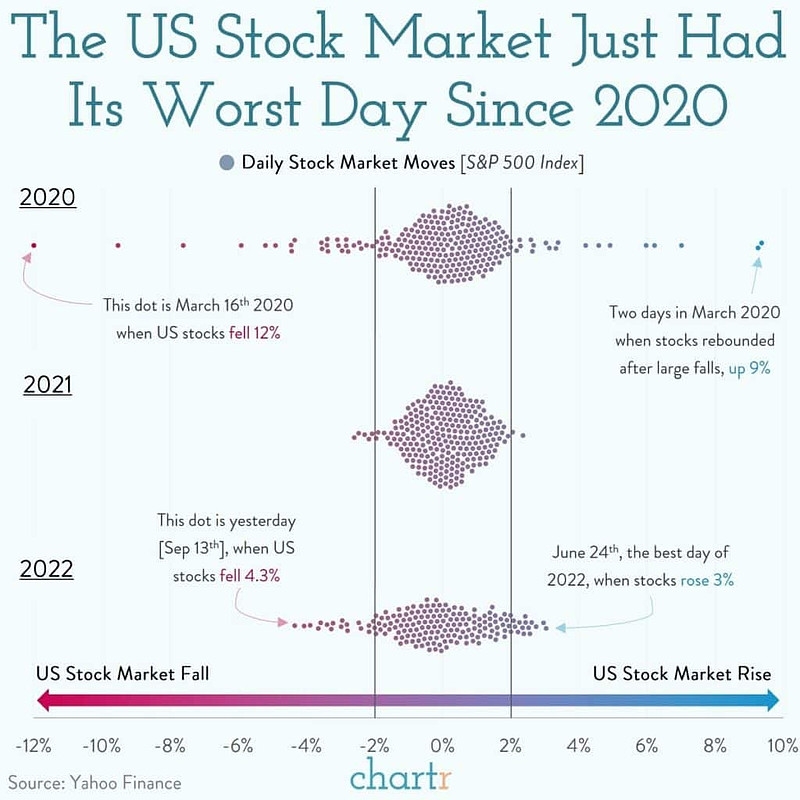

- Diversification: Investing in a diverse portfolio of US stocks can help mitigate risk and potentially increase returns.

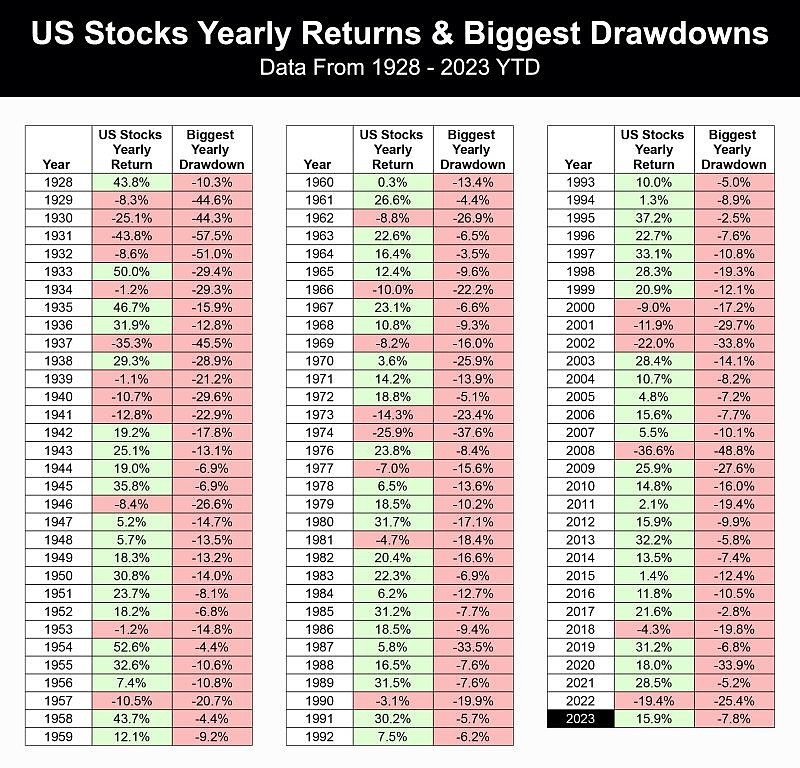

- Potential for High Returns: The US stock market has historically provided higher returns than many other markets worldwide.

- Access to Cutting-Edge Companies: The US is home to many of the world's most innovative and successful companies, offering international students the opportunity to invest in these businesses.

Case Study: Investing in Apple

Consider the case of a Chinese student studying in the United States. This student decides to invest

Conclusion

In conclusion, international students can indeed invest in US stocks. By meeting the eligibility requirements, opening a brokerage account, and understanding the various investment options, students can take advantage of the opportunities available in the US stock market. Investing in US stocks can provide a valuable source of income and help students achieve their financial goals.

new york stock exchange