Unlocking the Power of Investing: A Comprehensive Guide

author:US stockS -

In today's fast-paced financial world, understanding the art of investing is crucial for achieving financial stability and growth. Whether you're a seasoned investor or just starting out, this comprehensive guide will help you navigate the complexities of investing and make informed decisions. From the basics of stock market investing to the latest trends in cryptocurrency, we've got you covered.

Understanding the Basics of Investing

Investing is the process of allocating money with the expectation of generating an income or profit. There are various types of investments, including stocks, bonds, real estate, and more. Each type of investment carries its own set of risks and rewards, so it's important to understand the basics before diving in.

Stock Market Investing

Stock market investing is one of the most popular forms of investing. It involves buying shares of a company, which entitles you to a portion of the company's profits. To get started, you'll need to open a brokerage account and research potential stocks. Some key factors to consider when selecting stocks include the company's financial health, industry trends, and market sentiment.

Bonds and Fixed Income

Bonds are another popular investment option, offering fixed income over a set period of time. They are considered less risky than stocks, as they represent a loan to the issuer, which is typically a government or corporation. When investing in bonds, it's important to consider the issuer's credit rating and the bond's maturity date.

Real Estate Investing

Real estate investing involves purchasing property to generate income or capital appreciation. This can include residential, commercial, or industrial properties. While real estate investing can be lucrative, it also requires a significant amount of capital and time commitment.

Cryptocurrency and Alternative Investments

In recent years, cryptocurrency has gained significant attention as an alternative investment. Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that operate on blockchain technology. While they offer high potential returns, they also come with high volatility and regulatory risks.

Risk Management and Diversification

One of the most important aspects of investing is managing risk. This can be achieved through diversification, which involves spreading your investments across various asset classes and sectors. By diversifying your portfolio, you can reduce the impact of any single investment's performance on your overall returns.

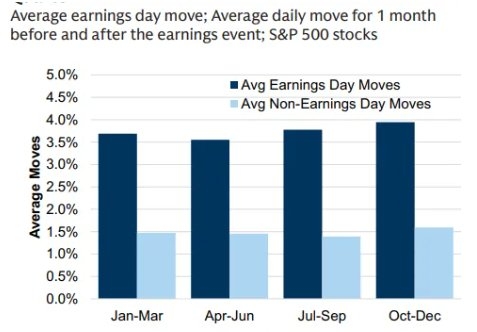

Case Study: The Impact of Diversification

Consider a hypothetical scenario where an investor only invests in technology stocks. If the technology sector experiences a downturn, the investor's portfolio could suffer significant losses. However, if the same investor diversifies their portfolio to include stocks from various sectors, such as healthcare, finance, and consumer goods, the impact of a downturn in any single sector would be mitigated.

Conclusion

Investing is a powerful tool for achieving financial goals, but it requires knowledge, discipline, and patience. By understanding the basics of investing, managing risk, and diversifying your portfolio, you can navigate the complexities of the financial world and secure a brighter financial future.

newsbreak stock