Unlocking Potential: The Thriving Landscape of Solar Energy Stocks in the US

author:US stockS -

In the ever-evolving landscape of renewable energy, solar energy stocks have emerged as a beacon of hope and innovation. The United States, with its abundant sunshine and growing commitment to sustainability, has become a hotbed for solar energy investments. This article delves into the thriving world of solar energy stocks in the US, highlighting key players, growth potential, and the future of this burgeoning industry.

Understanding the Solar Energy Sector

The solar energy sector encompasses companies involved in the production, installation, and maintenance of solar panels and related technologies. As the world grapples with climate change and the need for sustainable energy solutions, solar energy has gained significant traction. The US, being one of the largest markets for solar energy, offers immense opportunities for investors.

Top Solar Energy Stocks in the US

First Solar (FSLR) First Solar, a leader in photovoltaic (PV) solar panels, has been at the forefront of the solar energy revolution. With a focus on innovation and sustainability, First Solar has become a dominant player in the industry.

SolarEdge Technologies (SEDG) SolarEdge Technologies is renowned for its intelligent energy management solutions, including power optimizers, inverters, and monitoring platforms. The company's products enhance the efficiency and performance of solar systems, making it a valuable investment.

Sunrun (RUN) Sunrun, the largest dedicated residential solar company in the US, provides customers with comprehensive solar solutions, including installation, financing, and maintenance. The company's commitment to making solar energy accessible to all has propelled its growth.

Enphase Energy (ENPH) Enphase Energy is a leader in microinverter technology, which allows for increased efficiency and reliability in solar installations. The company's innovative products have earned it a reputation as a reliable solar energy provider.

SunPower (SPWR) SunPower, a solar technology innovator, offers high-efficiency solar panels and solutions for residential, commercial, and utility-scale applications. The company's focus on cutting-edge technology has positioned it as a key player in the solar energy sector.

Growth Potential and Market Trends

The solar energy sector in the US is experiencing rapid growth, driven by various factors:

Government Incentives: The federal government offers various incentives, such as the Investment Tax Credit (ITC) and the Solar Investment Tax Credit (ITC), to encourage the adoption of solar energy. These incentives have played a crucial role in the growth of the industry.

Technological Advancements: Continuous advancements in solar technology have led to increased efficiency and reduced costs, making solar energy more accessible and affordable.

Corporate Renewable Energy Goals: Many corporations are setting ambitious renewable energy goals, driving demand for solar energy solutions.

Climate Change Concerns: The growing awareness of climate change has prompted a shift towards sustainable energy sources, including solar power.

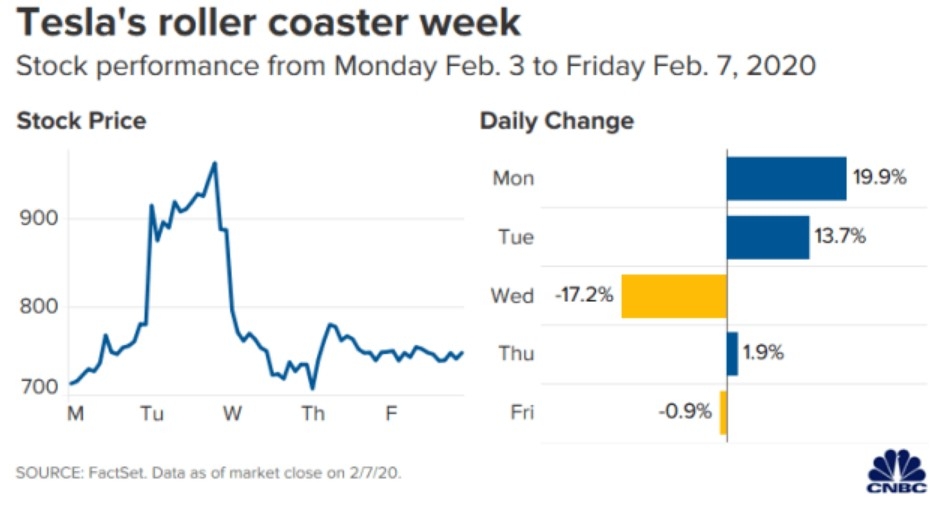

Case Study: Tesla's Solar City Acquisition

In 2016, Tesla acquired SolarCity, a leader in solar panel installation and energy storage solutions. This acquisition allowed Tesla to integrate its solar products with its electric vehicle offerings, creating a comprehensive energy ecosystem. The acquisition has been a successful move for Tesla, contributing to its growth and diversification.

Conclusion

The solar energy sector in the US is witnessing remarkable growth, driven by technological advancements, government incentives, and a growing demand for sustainable energy solutions. Solar energy stocks offer immense potential for investors looking to capitalize on this trend. By understanding the key players and market trends, investors can make informed decisions and unlock the potential of solar energy stocks in the US.

newsbreak stock