US Airline Stocks Drop: Understanding the Impact and Future Prospects

author:US stockS -

The recent downturn in US airline stocks has been a topic of concern for investors and industry watchers alike. This article delves into the reasons behind the decline and examines the potential future prospects for the aviation sector.

Reasons for the Drop

Several factors have contributed to the decline in US airline stocks. One of the primary reasons is the ongoing impact of the COVID-19 pandemic. The pandemic has significantly reduced air travel demand, leading to decreased revenue for airlines. Many airlines have had to slash their schedules and lay off employees to cope with the reduced demand.

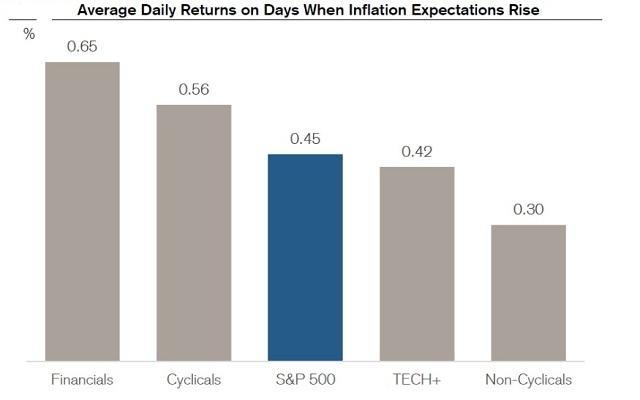

Fuel Prices and Inflation

Another contributing factor is the rise in fuel prices and inflation. Fuel costs represent a significant portion of an airline's operating expenses, and the increase in fuel prices has put additional strain on airlines' finances. Additionally, inflation has led to higher costs across the board, further impacting airline profitability.

Regulatory Challenges

Regulatory challenges have also played a role in the decline of airline stocks. New safety and security regulations have imposed additional costs on airlines, while antitrust concerns have raised questions about the industry's competitive landscape.

Case Study: Delta Air Lines

A notable example of the impact on airline stocks is Delta Air Lines. The company's stock has seen a significant decline, falling by over 20% in the past year. Delta's CEO, Ed Bastian, recently commented on the challenges faced by the airline industry, highlighting the need for a "reset" in operations and strategy.

Future Prospects

Despite the current downturn, there are reasons to be optimistic about the future of US airline stocks. As the pandemic subsides and travel demand recovers, airlines are expected to see a rebound in revenue. Many airlines are also investing in technology and efficiency improvements to enhance their competitive position.

Government Support

Government support has been a crucial factor in helping airlines navigate the pandemic. Bailout packages and stimulus measures have provided much-needed financial assistance to keep airlines afloat. As the economy recovers, this support may continue to play a role in the industry's recovery.

Conclusion

The recent drop in US airline stocks is a reflection of the challenges faced by the aviation sector. While the current situation is concerning, there are reasons to believe that the industry can recover and thrive in the future. As airlines adapt to the changing landscape and invest in their future, investors should keep a close eye on the industry's progress.

newsbreak stock