Title: How Are Things Doing on the US Stock Market?

author:US stockS -

Introduction

The United States stock market has been a vital indicator of the nation's economic health and a significant source of investment returns for individuals and institutions. With its vast array of stocks and industries, the US stock market has always been a dynamic and often unpredictable landscape. This article aims to delve into the current state of the US stock market, examining recent trends, market performance, and future outlook.

Recent Trends

1. Market Performance

As of early 2023, the US stock market has seen a rollercoaster of ups and downs. The S&P 500 has been a bellwether for the broader market, with fluctuations often reflecting economic and political events around the globe. While the market has experienced periods of volatility, it has also shown resilience in the face of challenges.

2. Sector Performance

Different sectors within the US stock market have performed differently over the past year. Technology stocks, particularly those in the FAANG group (Facebook, Amazon, Apple, Netflix, and Google), have been on a rollercoaster ride, with significant fluctuations in their valuations. On the other hand, sectors like healthcare and consumer discretionary have seen steady growth.

3. Impact of Inflation

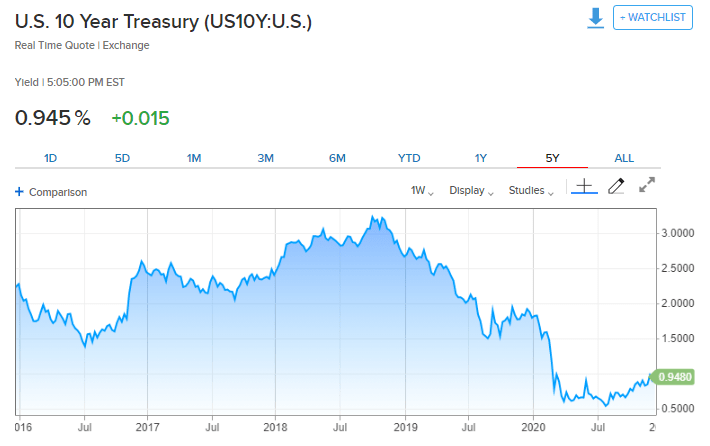

The US Federal Reserve has been battling inflation, raising interest rates to curb rising prices. This has had a mixed impact on the stock market, with some sectors, like real estate and utilities, benefiting from higher rates, while others, like technology and consumer discretionary, facing increased borrowing costs.

Market Performance Analysis: Case Study

One notable case study is the tech giant Apple. Despite the volatility in the tech sector, Apple has continued to deliver strong performance, driven by its robust product lineup and global market presence. The company's Q4 2022 earnings report showcased a 7% increase in revenue year-over-year, with a significant portion of its revenue coming from international markets.

Future Outlook

1. Economic Factors

The future of the US stock market will be heavily influenced by economic factors, including inflation, interest rates, and global economic conditions. While the Federal Reserve's fight against inflation may lead to short-term volatility, a strong economic outlook could bode well for long-term investment returns.

2. Market Sentiment

Market sentiment is another crucial factor to consider. As investor confidence rises, so does stock market performance. However, bearish sentiment can also lead to significant sell-offs, as witnessed during the COVID-19 pandemic.

3. Sector Opportunities

Investors looking to capitalize on future market trends should keep an eye on emerging sectors, such as renewable energy, healthcare, and technology. These sectors are poised for significant growth as the world transitions to a more sustainable and technologically advanced future.

Conclusion

The US stock market is a complex and ever-changing landscape, influenced by a multitude of factors. While it is difficult to predict the exact trajectory of the market, staying informed about economic trends, market performance, and sector opportunities can help investors make informed decisions. As the market continues to evolve, it is essential to remain adaptable and focused on long-term investment strategies.

newsbreak stock