Understanding the NASDAQ Stock Price: Trends, Factors, and Predictions

author:US stockS -

In the ever-evolving world of finance, the NASDAQ stock price stands as a pivotal indicator of market sentiment and economic health. This article delves into the factors that influence the NASDAQ stock price, its historical trends, and what investors should consider when analyzing this crucial market index.

Historical Trends

The NASDAQ Composite Index, which tracks the performance of over 3,000 companies, has seen significant fluctuations over the years. From its inception in 1971 to the dot-com bubble of the late 1990s, the index skyrocketed, reflecting the explosive growth of technology companies. However, the bubble burst in 2000, leading to a sharp decline in the NASDAQ. Since then, the index has recovered and continued to grow, with several notable peaks and troughs along the way.

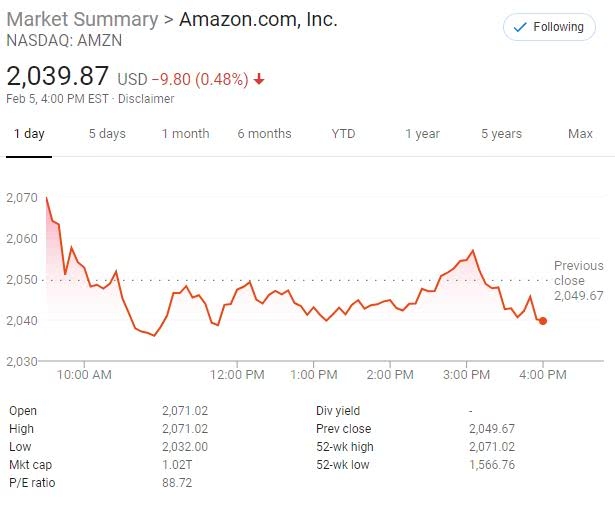

One such peak occurred in 2007, just before the global financial crisis. The NASDAQ plummeted as the crisis unfolded, but it quickly recovered and reached new highs in the following years. In recent years, the index has been driven by the rise of technology giants like Apple, Microsoft, and Amazon.

Factors Influencing the NASDAQ Stock Price

Several factors contribute to the fluctuation of the NASDAQ stock price. Here are some of the key influencers:

Economic Indicators: Economic reports, such as unemployment rates, inflation, and GDP growth, can significantly impact investor confidence and, consequently, the NASDAQ stock price.

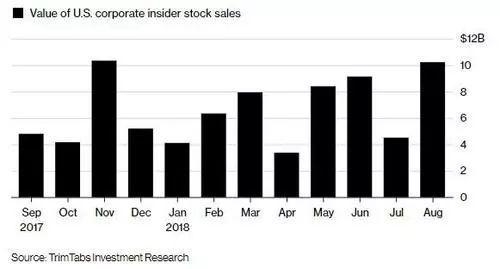

Market Sentiment: The overall mood of the market can drive the NASDAQ. For example, during periods of optimism, investors may be more willing to take on risk, leading to higher stock prices.

Technological Developments: As the NASDAQ is heavily weighted towards technology stocks, advancements in the tech sector can have a substantial impact on the index.

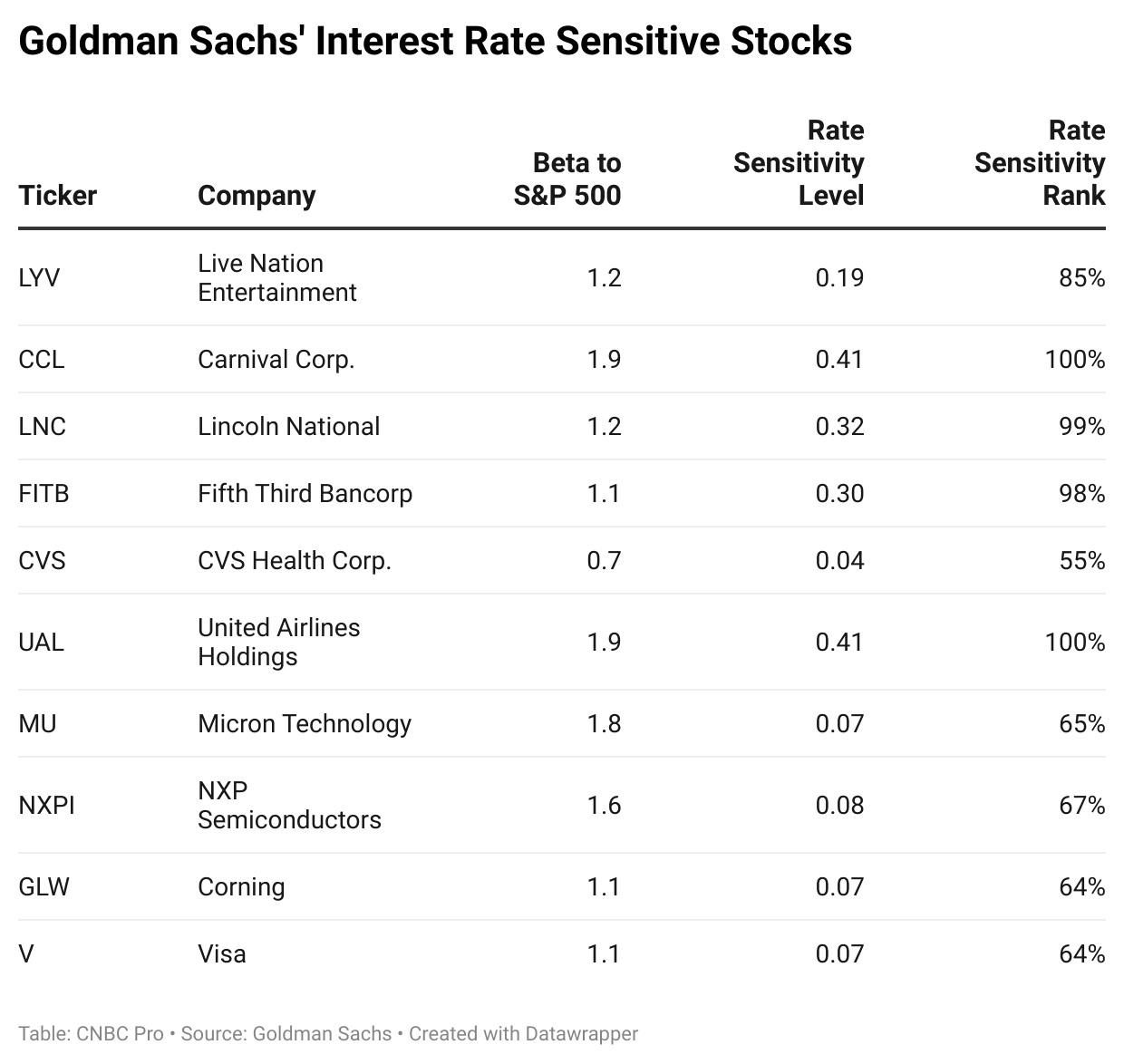

Interest Rates: Central bank policies, particularly interest rate changes, can influence investor behavior and, subsequently, the NASDAQ stock price.

Political Events: Global political events, such as elections or trade disputes, can create uncertainty and volatility in the market.

Predictions for the Future

Predicting the future of the NASDAQ stock price is challenging, but some experts offer insights based on current trends and economic conditions. Some analysts believe that the index will continue to grow due to the increasing importance of technology in our lives. Others caution that potential risks, such as rising inflation or geopolitical tensions, could lead to volatility.

Case Study: Facebook's Impact on the NASDAQ

One notable case study involves Facebook's initial public offering (IPO) in 2012. The company's IPO was the largest in history at the time, and it had a significant impact on the NASDAQ. As Facebook's stock price soared, the NASDAQ Composite Index also saw a boost. However, the stock eventually fell short of expectations, and the NASDAQ experienced a brief period of volatility.

Conclusion

The NASDAQ stock price is a complex and dynamic indicator of market conditions. By understanding the historical trends, key influencers, and future predictions, investors can better navigate the world of NASDAQ investing. Whether you're a seasoned trader or a beginner, staying informed about the NASDAQ is crucial for making informed investment decisions.

us stock market today live cha