Stock Market is Going Down: What You Need to Know

author:US stockS -

The stock market has been a rollercoaster ride for investors in recent months, and the trend seems to be heading downwards. If you're considering investing or have already invested in the stock market, it's crucial to understand the factors contributing to this downward trend and how it might impact your portfolio. In this article, we'll explore the reasons behind the stock market's decline and provide some tips for navigating this challenging environment.

Reasons for the Stock Market Decline

Economic Concerns: The global economy has been facing several challenges, including rising inflation, supply chain disruptions, and the ongoing COVID-19 pandemic. These factors have led to increased uncertainty and a decline in investor confidence.

Interest Rate Hikes: Central banks around the world have been raising interest rates to combat inflation. Higher interest rates make borrowing more expensive, which can negatively impact corporate earnings and consumer spending.

Geopolitical Tensions: The ongoing tensions between major economies, such as the US and China, have also contributed to the stock market's decline. These tensions have raised concerns about global trade and economic stability.

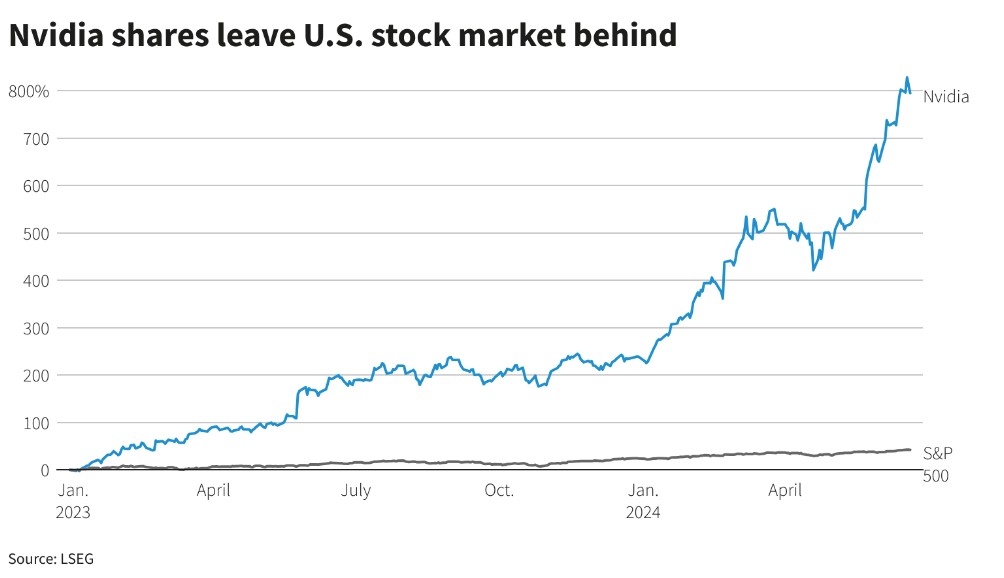

Tech Sector Pullback: The technology sector, which has been a major driver of the stock market's growth in recent years, has experienced a significant pullback. This is due to concerns about valuation and increased regulatory scrutiny.

Navigating the Decline

Diversify Your Portfolio: Diversification is key to mitigating risk in a declining stock market. By investing in a mix of assets, including stocks, bonds, and real estate, you can reduce your exposure to any single sector or market.

Stay the Course: It's important to remember that stock market declines are a normal part of the investing cycle. Staying the course and avoiding panic selling can help you ride out the downturn and potentially benefit from future market gains.

Review Your Investment Strategy: Take this opportunity to review your investment strategy and ensure it aligns with your financial goals and risk tolerance. Consider adjusting your asset allocation if necessary.

Consider Dividend Stocks: Dividend stocks can provide a steady income stream and offer some protection against market downturns. Look for companies with a strong track record of paying dividends and a solid financial position.

Keep an Eye on Economic Indicators: Monitoring economic indicators, such as inflation rates, interest rates, and GDP growth, can help you stay informed about the market's direction and make more informed investment decisions.

Case Study: Tesla's Stock Decline

One recent example of a stock market decline is the case of Tesla, Inc. (TSLA). In the past year, Tesla's stock has experienced a significant drop, falling from a peak of over

Despite the decline, Tesla remains one of the most valuable companies in the world. This example highlights the importance of understanding the underlying factors driving a stock's price and not simply reacting to short-term market movements.

In conclusion, the stock market's downward trend is a cause for concern, but it's also an opportunity to reassess your investment strategy and ensure you're prepared for the challenges ahead. By staying informed, diversifying your portfolio, and maintaining a long-term perspective, you can navigate this challenging environment and potentially come out stronger on the other side.

us stock market today live cha