Market Overview: US Stocks in October 2025

author:US stockS -

In October 2025, the US stock market showcased a mix of optimism and caution, reflecting the intricate balance between economic growth and potential risks. This article delves into the key trends, market performance, and future outlook for US stocks during this pivotal month.

Economic Indicators and Market Trends

The US economy in October 2025 was characterized by a strong labor market and moderate inflation. The unemployment rate remained low, reflecting the robustness of the job market. However, inflationary pressures continued to be a concern, prompting the Federal Reserve to maintain a cautious stance on monetary policy.

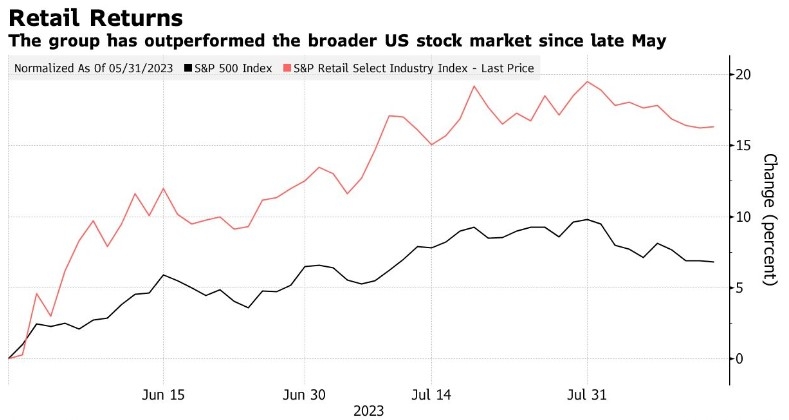

Sector Performance

The technology sector, traditionally a leader in the US stock market, experienced mixed results in October 2025. Tech giants like Apple and Microsoft reported strong earnings, driven by robust demand for their products and services. However, concerns about rising interest rates and global economic uncertainty impacted the valuations of tech stocks.

On the other hand, the energy sector emerged as a significant performer in October 2025. Oil prices stabilized, providing a much-needed boost to energy stocks. The rise in oil prices was attributed to geopolitical tensions and supply disruptions in key producing regions.

Market Volatility

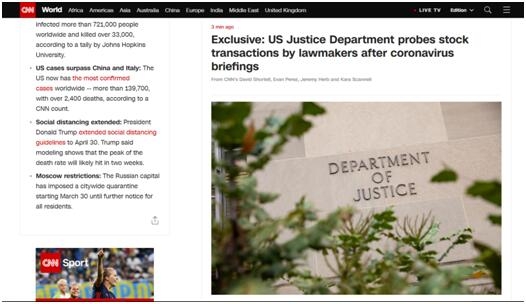

October 2025 witnessed significant market volatility, with investors reacting to a range of economic and geopolitical factors. Stock market indices experienced sharp ups and downs, reflecting the uncertainty surrounding global economic conditions. However, the market eventually stabilized, with investors focusing on companies with strong fundamentals and sustainable growth prospects.

Inflation and Interest Rates

The Federal Reserve's monetary policy remained a key driver of market sentiment in October 2025. The central bank continued to emphasize the need to control inflation, leading to expectations of further interest rate hikes. This uncertainty created volatility in the bond market and impacted the valuations of growth stocks.

Investor Sentiment

Investor sentiment in October 2025 was cautiously optimistic. Value investors focused on companies with strong fundamentals and sustainable growth prospects, while growth investors remained interested in high-growth sectors like technology and healthcare. The rise in merger and acquisition (M&A) activity also contributed to a positive investor sentiment.

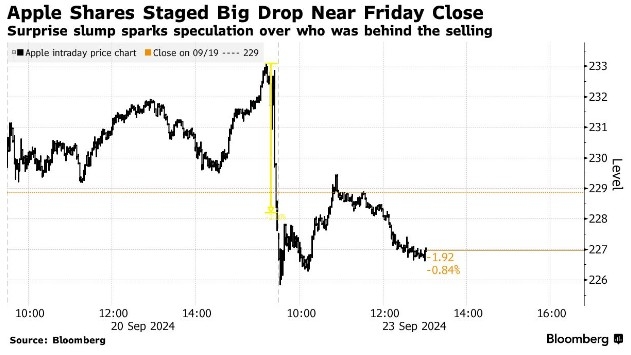

Case Study: Apple Inc.

Apple Inc., one of the most influential companies in the world, reported strong earnings in October 2025. The company's iPhone sales continued to grow, driven by the launch of new models and increased demand in emerging markets. Apple's services segment also performed well, with strong growth in areas like Apple Music and iCloud.

Despite the strong earnings, Apple's stock experienced volatility in October 2025. This was attributed to concerns about rising interest rates and global economic uncertainty. However, the company's strong fundamentals and long-term growth prospects continued to attract investors.

Conclusion

October 2025 marked a month of mixed results for the US stock market. While economic indicators remained positive, market volatility and concerns about inflation and interest rates created uncertainty. However, investors remained optimistic about the long-term prospects of the US stock market, focusing on companies with strong fundamentals and sustainable growth prospects.

us stock market today live cha