How Indian Investors Can Navigate the US Stock Market

author:US stockS -

In recent years, the US stock market has become an attractive destination for international investors, including those from India. With its robust economy, diverse sectors, and stable regulatory environment, the US stock market offers numerous opportunities for investors. If you're an Indian investor looking to tap into this market, here's a comprehensive guide to help you navigate the process.

Understanding the Basics

Before diving into the US stock market, it's crucial to have a solid understanding of the basics. This includes familiarizing yourself with the different types of stocks, such as common and preferred stocks, as well as the various stock exchanges, like the New York Stock Exchange (NYSE) and the NASDAQ.

Opening a Brokerage Account

To invest in the US stock market, you'll need to open a brokerage account. There are several online brokers that cater to international investors, such as TD Ameritrade, E*TRADE, and Charles Schwab. These brokers offer user-friendly platforms, competitive fees, and access to a wide range of investment options.

When opening an account, you'll need to provide personal information, including your name, address, and tax identification number. You may also need to provide proof of identity and residency. It's important to choose a reputable broker that offers robust security measures to protect your investments.

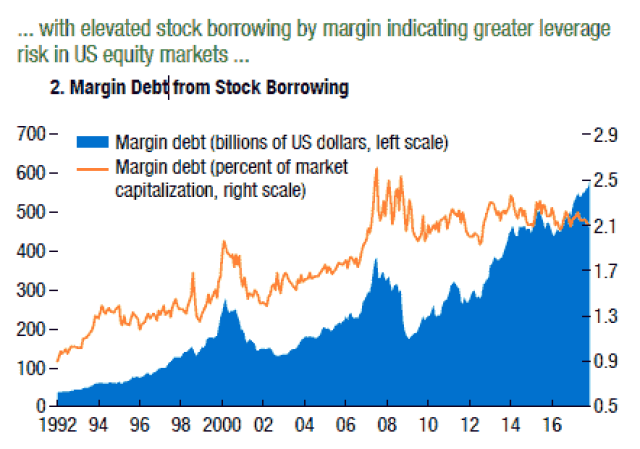

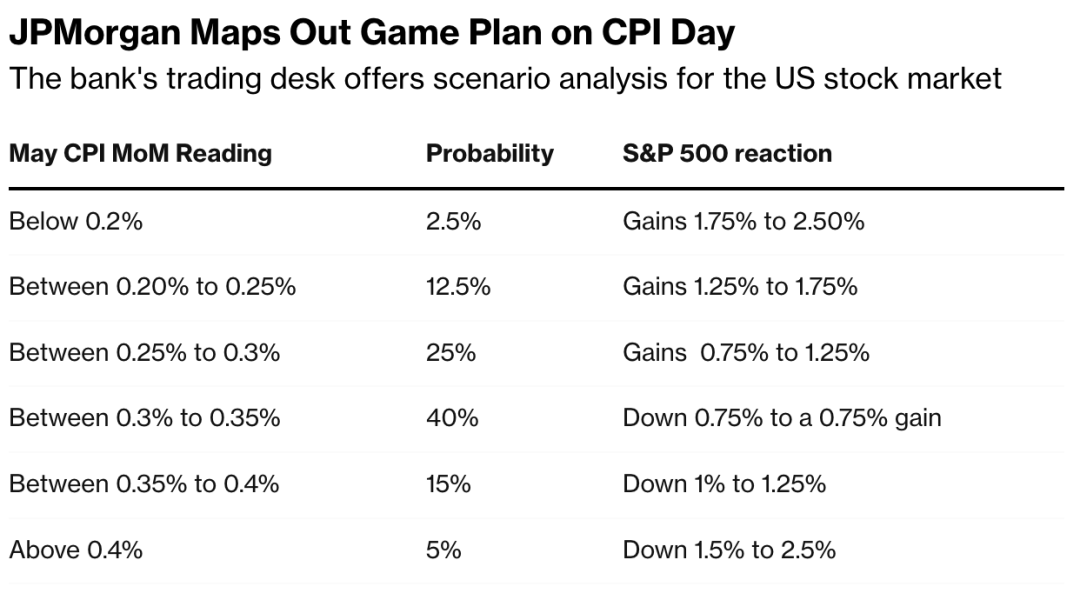

Understanding Risk and Diversification

As with any investment, it's essential to understand the risks involved. The US stock market can be volatile, and there's always a risk of losing your investment. To mitigate this risk, it's important to diversify your portfolio by investing in a variety of stocks across different sectors and industries.

Using ETFs and Mutual Funds

For Indian investors who may not be familiar with the US stock market, Exchange-Traded Funds (ETFs) and mutual funds can be a great way to gain exposure to the market. These investment vehicles pool money from multiple investors and use it to buy a diversified portfolio of stocks, bonds, or other assets.

Several ETFs and mutual funds are available that focus on the US market, making it easier for Indian investors to gain exposure. Some popular options include the Vanguard S&P 500 ETF (VOO) and the Fidelity US Equity Income Fund (FUSIX).

Using Stop-Loss Orders

To protect your investments, consider using stop-loss orders. A stop-loss order is an instruction to sell a stock when it reaches a certain price. This helps limit your potential losses if the stock's price falls significantly.

Keeping Track of Your Investments

Once you've invested in the US stock market, it's important to keep track of your investments. Most online brokers offer real-time tracking and reporting tools, allowing you to monitor your portfolio's performance and make informed decisions.

Case Study: An Indian Investor's Journey

Consider the case of Mr. Gupta, an Indian investor who opened a brokerage account with E*TRADE and invested in a mix of US stocks and ETFs. By diversifying his portfolio and using stop-loss orders, Mr. Gupta was able to navigate the volatility of the US stock market and achieve a positive return on his investments.

Conclusion

Investing in the US stock market can be a lucrative opportunity for Indian investors. By understanding the basics, opening a brokerage account, diversifying your portfolio, and using risk management strategies, you can successfully navigate the US stock market and achieve your investment goals.

us stock market today live cha