Do International Stocks Do Better When US Stocks Are Down?

author:US stockS -

In the volatile world of global finance, many investors wonder: do international stocks perform better when US stocks are down? This question is crucial for investors looking to diversify their portfolios and navigate the unpredictable nature of the stock market. In this article, we'll explore the relationship between US and international stock performance, providing insights and analysis to help you make informed investment decisions.

Understanding the Relationship

When US stocks are down, it's natural to consider international markets as a potential safe haven. However, the relationship between these markets is complex and influenced by various factors. To understand this connection, we need to look at several key aspects:

Economic Factors: The performance of US stocks is closely tied to the US economy. When the US economy is struggling, it can lead to a decline in US stock prices. Conversely, strong economic growth in other countries can drive international stock performance.

Currency Fluctuations: Currency exchange rates play a significant role in the performance of international stocks. When the US dollar strengthens, it can make international stocks less attractive, and vice versa.

Market Sentiment: Investor sentiment can also impact the performance of both US and international stocks. During times of uncertainty, investors may seek refuge in international markets, leading to increased demand and potentially higher prices.

International Stock Performance During Downturns

Historically, international stocks have shown mixed results during periods when US stocks are down. Some key points to consider include:

Emerging Markets: Emerging markets, such as those in Asia and Latin America, have often performed well during US stock downturns. This is due to their strong growth potential and lower correlation with the US economy.

Developed Markets: Developed markets, such as those in Europe and Japan, have sometimes struggled during US stock downturns. This is because these markets are more closely tied to the US economy and may be affected by similar economic factors.

Currency Fluctuations: In some cases, currency fluctuations have played a significant role in the performance of international stocks. For example, when the US dollar strengthens, it can make international stocks less attractive, even if their underlying fundamentals are strong.

Case Studies

To illustrate the relationship between US and international stock performance, let's look at a few case studies:

2008 Financial Crisis: During the 2008 financial crisis, US stocks plummeted, but international stocks, particularly those in emerging markets, actually saw modest gains. This was due to their strong growth potential and lower correlation with the US economy.

2020 COVID-19 Pandemic: The COVID-19 pandemic caused a significant downturn in US stocks. However, international stocks, particularly those in Asia, performed relatively well, driven by their strong growth potential and lower exposure to the pandemic's impact.

Conclusion

While there is no one-size-fits-all answer to whether international stocks do better when US stocks are down, it's clear that the relationship is complex and influenced by various factors. By understanding these factors and conducting thorough research, investors can make informed decisions and potentially benefit from diversifying their portfolios. Whether you're considering emerging markets or developed markets, it's important to stay informed and adapt your strategy to changing market conditions.

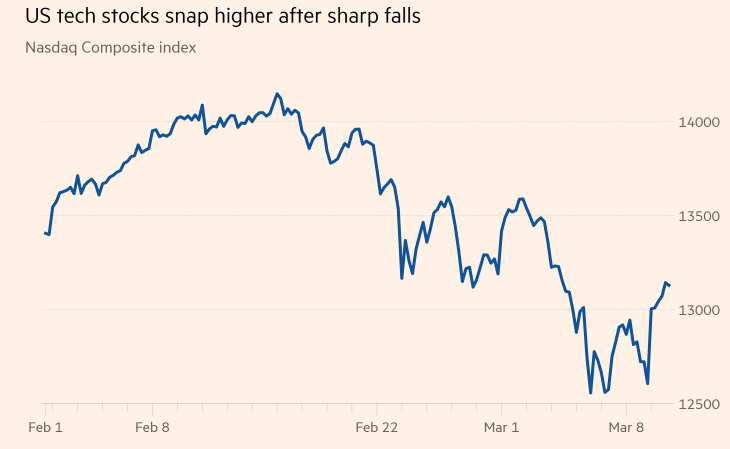

us stock market today live cha