Understanding the Impact of Institutional Ownership of US Stocks

author:US stockS -

In the vast and dynamic world of the US stock market, institutional ownership plays a pivotal role. This article delves into the concept, its implications, and the factors influencing institutional ownership of US stocks. By the end, you'll have a clearer understanding of how this ownership structure impacts the market and individual investors.

What is Institutional Ownership?

Institutional ownership refers to the share of a company's stock owned by institutions such as mutual funds, pension funds, insurance companies, and hedge funds. These institutions typically hold significant stakes in companies, often surpassing individual investors. The influence of institutional ownership is profound, as these entities often have a substantial say in corporate governance and strategic decisions.

The Influence of Institutional Ownership

Institutional ownership has a significant impact on the US stock market. Here are some key points to consider:

- Market Stability: Institutions are known for their long-term investment horizon. Their presence in the market can contribute to stability, as they are less likely to engage in speculative trading.

- Corporate Governance: Institutions often push for better corporate governance practices, including transparency, accountability, and ethical conduct. This can lead to improved company performance and shareholder value.

- Market Efficiency: Institutions' active participation in the market can enhance its efficiency. They analyze companies thoroughly and invest in those with strong fundamentals, driving up their stock prices and reflecting their true value.

- Impact on Stock Price: The level of institutional ownership can significantly impact a stock's price. An increase in institutional ownership often leads to higher stock prices, as institutions are seen as a vote of confidence in the company.

Factors Influencing Institutional Ownership

Several factors influence institutional ownership of US stocks:

- Company Performance: Institutions are more likely to invest in companies with strong financial performance, high profitability, and promising growth prospects.

- Sector and Industry Trends: Institutions often invest in sectors and industries that align with their investment mandates and expertise.

- Regulatory Environment: Changes in regulations, such as those affecting financial institutions or retirement funds, can impact institutional ownership.

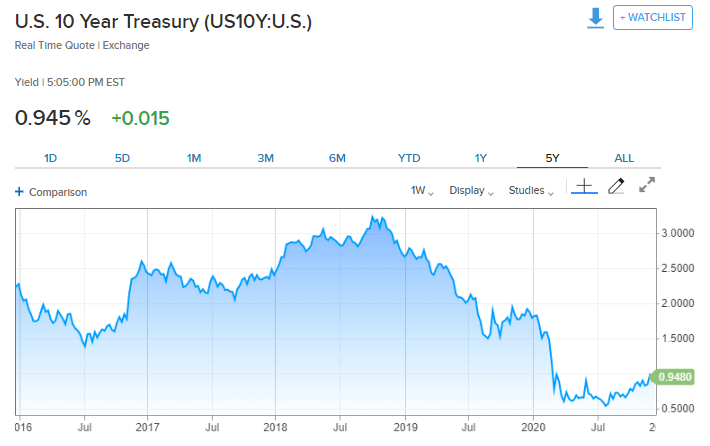

- Economic Conditions: Economic factors like interest rates, inflation, and economic growth can influence institutional investment decisions.

Case Study: Institutional Ownership in Tech Giants

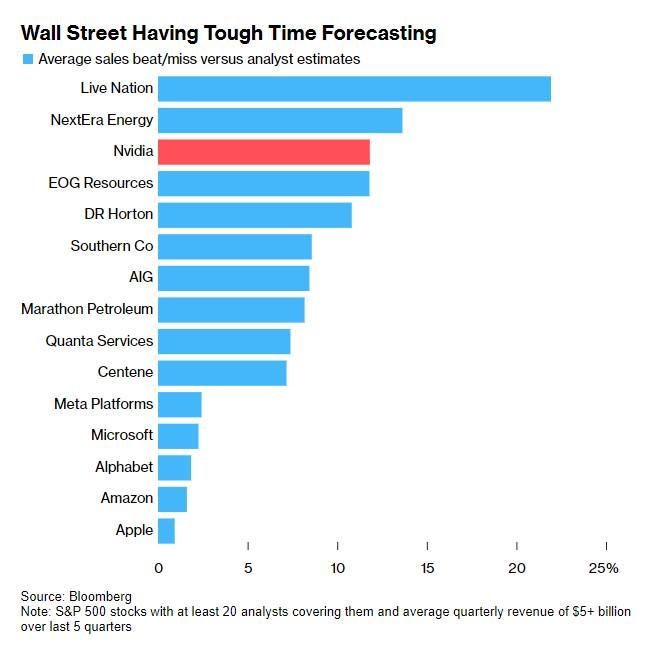

Consider the case of tech giants like Apple, Microsoft, and Google. These companies have seen a surge in institutional ownership over the years. This is due to their strong financial performance, market dominance, and innovative business models. Institutions see these companies as stable and profitable investments, driving up their stock prices and solidifying their positions as market leaders.

Conclusion

Institutional ownership of US stocks is a critical factor shaping the market. By understanding its impact, investors can gain insights into market trends, corporate governance, and investment opportunities. As you navigate the US stock market, keep an eye on institutional ownership and its implications for your investments.

us stock market today