Understanding the Dow Jones Averages: A Comprehensive Guide

author:US stockS -

The Dow Jones Averages are among the most widely followed stock market indices in the world. They provide a snapshot of the overall performance of the stock market and are used by investors, traders, and analysts to gauge market trends and make informed decisions. This article aims to provide a comprehensive guide to the Dow Jones Averages, covering their history, components, and how they are used in the financial world.

The History of the Dow Jones Averages

The Dow Jones Industrial Average (DJIA), the most well-known of the Dow Jones Averages, was first published on May 26, 1896, by Charles Dow. It was created to provide a simple and easy-to-understand measure of the stock market's performance. The DJIA consists of 30 large, publicly-traded companies that are selected based on their market capitalization, liquidity, and industry representation.

Over the years, the Dow Jones Averages have expanded to include other indices, such as the Dow Jones Transportation Average and the Dow Jones Utility Average. These indices provide a more comprehensive view of the market, covering different sectors and asset classes.

Components of the Dow Jones Averages

The Dow Jones Industrial Average includes 30 large, publicly-traded companies from various industries, such as technology, finance, healthcare, and consumer goods. Some of the most well-known companies in the DJIA include Apple, Microsoft, Johnson & Johnson, and ExxonMobil.

The Dow Jones Transportation Average consists of 20 transportation companies, including airlines, railroads, and shipping companies. This index provides insight into the health of the transportation sector and the broader economy.

The Dow Jones Utility Average includes 15 utility companies, such as electric and gas companies. This index is often used to gauge the performance of the energy sector and the stability of the economy.

How the Dow Jones Averages Are Used

The Dow Jones Averages are widely used by investors and traders to make informed decisions. Here are some of the ways they are used:

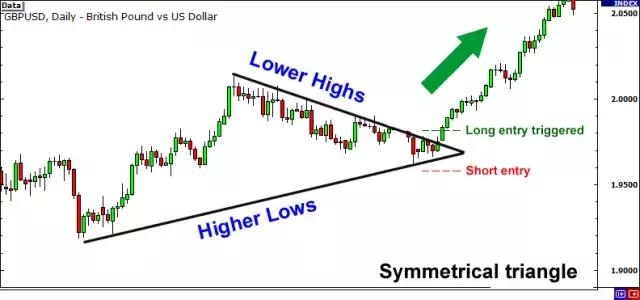

- Market Trend Analysis: The Dow Jones Averages can be used to identify market trends and make predictions about future market movements.

- Investment Strategy: Investors can use the Dow Jones Averages to build diversified portfolios that align with their investment goals and risk tolerance.

- Comparative Analysis: The Dow Jones Averages can be used to compare the performance of different sectors and asset classes.

Case Study: The Impact of the 2020 COVID-19 Pandemic on the Dow Jones Averages

The COVID-19 pandemic had a significant impact on the stock market, and the Dow Jones Averages were no exception. In February 2020, the DJIA experienced its worst one-day decline since the 1987 stock market crash. However, the index quickly recovered and reached new highs by the end of the year.

This case study illustrates the volatility and resilience of the stock market. The Dow Jones Averages can be used to track these changes and help investors make informed decisions during times of uncertainty.

Conclusion

The Dow Jones Averages are essential tools for investors and traders looking to understand the stock market's performance and make informed decisions. By understanding the history, components, and uses of the Dow Jones Averages, investors can gain valuable insights into the market and improve their investment strategies.

us stock market today