US Government Shutdown Impact on Stocks: A Comprehensive Analysis

author:US stockS -Impact(5)Government(1)Shutdown(1)Sto(5)

The recent US government shutdown has sent ripples through the financial markets, particularly impacting stocks. This article delves into the effects of the shutdown on the stock market, providing insights into how investors can navigate through such turbulent times.

Understanding the Shutdown

The US government shutdown, which began on December 22, 2018, was a result of a budget impasse between the Democratic-controlled House of Representatives and the Republican-controlled Senate. This shutdown, which lasted 35 days, was the longest in U.S. history.

Impact on the Stock Market

The shutdown had a significant impact on the stock market. Here's how:

- Uncertainty: The shutdown created uncertainty among investors, leading to volatility in the stock market. This uncertainty stemmed from the fear of a prolonged shutdown, which could lead to a recession.

- Economic Data: The shutdown halted the release of several economic reports, including the monthly jobs report. This lack of data made it difficult for investors to make informed decisions.

- Consumer Spending: The shutdown affected federal employees, many of whom were furloughed or working without pay. This, in turn, impacted consumer spending, which is a major driver of the U.S. economy.

- Interest Rates: The Federal Reserve, which had been considering raising interest rates, decided to hold off due to the uncertainty caused by the shutdown.

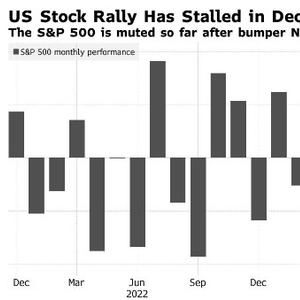

Stock Market Performance

The shutdown had a varied impact on different sectors of the stock market:

- Tech Stocks: Tech stocks, which are often seen as a barometer of the overall market, remained relatively stable during the shutdown. This was due to their strong fundamentals and global nature.

- Financial Stocks: Financial stocks, which are sensitive to interest rate changes, saw a decline during the shutdown. This was due to the uncertainty surrounding the Fed's interest rate decisions.

- Consumer Discretionary Stocks: Consumer discretionary stocks, which are sensitive to consumer spending, saw a decline during the shutdown. This was due to the impact on federal employees and their families.

Case Studies

Several companies experienced a direct impact from the shutdown. For example:

- Walmart: Walmart reported a decline in sales during the shutdown, as federal employees and their families cut back on spending.

- Apple: Apple, which relies heavily on government contracts, saw a slight impact on its business due to the shutdown.

Conclusion

The US government shutdown had a significant impact on the stock market. While some sectors were more affected than others, the overall market remained relatively stable. Investors should remain vigilant and stay informed about political developments, as they can have a significant impact on the stock market.

us stock market today