Trade War Between US and China: Impact on Stock Market

author:US stockS -

The Current Trade Standoff

The ongoing trade war between the United States and China has been a hot topic in global economic circles. This battle, which has seen tariffs being imposed on a vast array of goods and services, has not only affected the economies of both nations but has also had significant repercussions on the global stock market.

Stock Market Turmoil

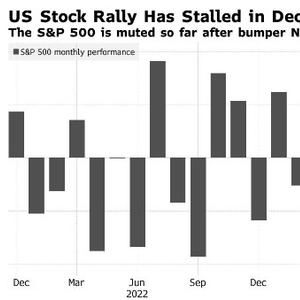

The US stock market, which has long been seen as a barometer of economic health, has experienced significant volatility as a result of the trade tensions. The S&P 500, a widely followed index, has seen its value fluctuate dramatically in recent months. “The S&P 500 has seen a decline of nearly 10% since the start of the trade war,” noted an expert from CNBC.

Impact on Chinese Stock Market

Similarly, the Chinese stock market has also been adversely affected. The Shanghai Composite Index, one of the most important indices in China, has witnessed a significant drop. “The Shanghai Composite has lost about 20% of its value since the trade war began,” stated an analyst from Bloomberg.

Industry-Specific Impacts

The trade war has had a profound impact on specific sectors. For instance, technology stocks, which are heavily reliant on trade with China, have seen a considerable drop. “Tech stocks have been among the hardest hit, with many of the largest companies in the sector seeing their stock prices fall by double digits,” explained an expert from Fox Business.

Geopolitical Ramifications

The trade war has also had significant geopolitical implications. It has strained relations between the two nations, leading to concerns about a broader conflict. “The trade war has raised tensions between the US and China, and there are fears that this could lead to a more severe geopolitical situation,” warned a political analyst from CNN.

Case Studies

To illustrate the impact of the trade war on the stock market, let’s look at a couple of case studies:

Apple Inc.: As one of the largest tech companies in the world, Apple relies heavily on its supply chain in China. The imposition of tariffs on Chinese imports has led to increased production costs for Apple, which has in turn affected its stock price.

Tesla Inc.: Tesla has also been affected by the trade war. The company has significant operations in China, and the imposition of tariffs on its products has led to a decline in its stock price.

Conclusion

The trade war between the US and China has had a significant impact on the global stock market. The volatility seen in the stock markets of both nations is a testament to the far-reaching effects of this conflict. As the trade war continues, it remains to be seen how the stock markets will respond.

us stock market today