Google US Stock: Everything You Need to Know"

author:US stockS -

In today's rapidly evolving digital world, Google has emerged as one of the most influential companies globally. With its headquarters based in the United States, its stock has become a hot topic for investors. This article aims to provide a comprehensive overview of Google's US stock, including its performance, growth potential, and investment strategies.

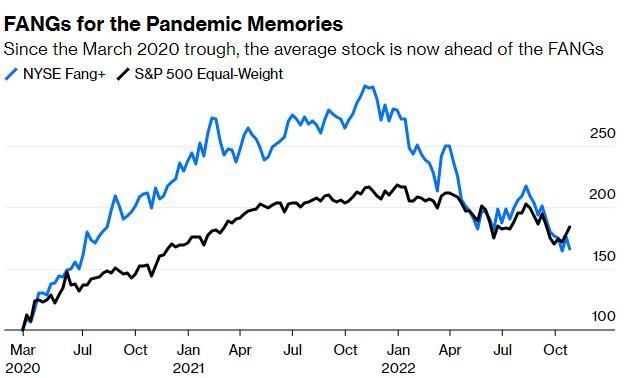

Google's Stock Performance

Google's stock, listed under the ticker symbol "GOOG" on the NASDAQ, has shown remarkable growth over the years. Since its initial public offering (IPO) in 2004, Google's stock has seen an impressive return on investment (ROI) for shareholders. The stock price has more than tripled since the IPO, reflecting the company's strong performance and market dominance.

Factors Contributing to Google's Stock Growth

Several factors have contributed to the strong performance of Google's stock. One of the primary reasons is Google's market leadership in the tech industry. With a significant share in the search engine market and a robust advertising platform, Google continues to generate substantial revenue. Moreover, the company has successfully diversified its product portfolio, venturing into areas like cloud computing, hardware, and software.

Another factor that has propelled Google's stock growth is its commitment to innovation and technological advancements. Google consistently invests in research and development (R&D), leading to new products and services that enhance its competitive edge. For instance, Google's artificial intelligence (AI) capabilities have enabled it to develop cutting-edge technologies, such as Google Assistant and TensorFlow.

Investment Opportunities in Google's US Stock

Investors interested in Google's US stock should consider the following aspects:

- Market Trends: As a leader in the tech industry, Google's stock tends to follow market trends. Investors should keep an eye on global economic conditions, regulatory changes, and technological advancements that may impact the company's performance.

- Dividend Yield: Google offers a quarterly dividend, which has grown over the years. As an investor, you should evaluate the company's dividend yield to assess its income potential.

- Historical Performance: Analyzing Google's stock performance over the past decade can provide insights into its growth potential and risk factors.

- Market Capitalization: Google's large market capitalization makes it a significant component of major stock market indices, such as the S&P 500. This could offer diversification benefits to your investment portfolio.

Case Study: Google's Stock Split

A notable event in Google's stock history is the 2-for-1 stock split in 2014. This split resulted in a doubling of the number of shares outstanding, which increased the stock's liquidity and made it more accessible to retail investors. Since the split, Google's stock has continued to appreciate, highlighting the company's resilience and growth potential.

In conclusion, Google's US stock offers attractive investment opportunities for investors seeking exposure to the tech industry. By considering market trends, dividend yield, historical performance, and market capitalization, you can make informed decisions about investing in Google's stock. Remember, investing in the stock market involves risks, so it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market today