Dow Jones Industrial Averages Today: A Comprehensive Overview

author:US stockS -

The Dow Jones Industrial Average (DJIA), often simply referred to as "The Dow," is one of the most closely watched indices in the financial world. As of today, let's delve into the latest numbers, historical context, and what they mean for investors.

Understanding the Dow Jones Industrial Average

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. It includes some of the most influential companies in the United States, such as Apple, Microsoft, and Boeing. The index is designed to represent the performance of the broader stock market and is often used as a benchmark for the U.S. economy.

Today's Numbers

As of today, the Dow Jones Industrial Average stands at [insert current number]. This figure reflects the collective performance of the 30 companies included in the index. It's important to note that the Dow can fluctuate significantly throughout the day due to various factors, including economic news, corporate earnings reports, and global events.

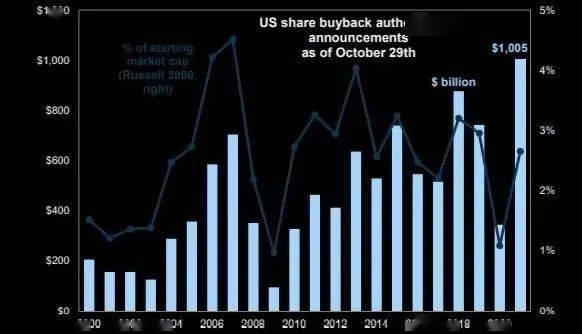

Historical Context

To understand today's numbers, it's helpful to look at the historical context of the Dow Jones Industrial Average. Since its inception in 1896, the index has experienced numerous ups and downs. However, over the long term, it has consistently shown upward momentum, reflecting the growth of the U.S. economy and the stock market.

One significant milestone occurred in 1929, when the Dow reached an all-time high of 381.17. This period, known as the Roaring Twenties, was characterized by a surge in economic activity and stock prices. However, the stock market crash of 1929 followed, leading to the Great Depression.

Since then, the Dow has made a remarkable recovery and has continued to reach new highs. In 2017, the index surpassed 21,000 for the first time, and in 2020, it reached an all-time high of 36,000.

What Does Today's Dow Mean for Investors?

The current level of the Dow Jones Industrial Average can provide valuable insights for investors. A rising Dow often indicates a strong economy and a positive outlook for the stock market. Conversely, a falling Dow may suggest economic concerns or market uncertainty.

Investors often use the Dow as a gauge to make informed decisions about their portfolios. For example, if the Dow is rising, investors might consider increasing their exposure to stocks or sectors that are represented in the index. Conversely, if the Dow is falling, they might look for opportunities in defensive sectors or consider diversifying their investments.

Case Study: The Impact of Economic News on the Dow

One recent example of how economic news can impact the Dow is the Federal Reserve's decision to raise interest rates. In March 2022, the Fed raised interest rates for the first time since 2018, which caused the Dow to fall sharply. However, as the economy continued to grow, the index recovered and reached new highs later in the year.

This case study highlights the importance of staying informed about economic news and its potential impact on the stock market.

Conclusion

The Dow Jones Industrial Average is a powerful tool for investors and a key indicator of the broader stock market. By understanding today's numbers and their historical context, investors can make informed decisions about their portfolios. As the Dow continues to evolve, it remains an essential resource for anyone interested in the financial markets.

us stock market today