2 Stock Indexes in the US: A Comprehensive Guide

author:US stockS -

In the vast landscape of the United States stock market, two indexes stand out as the most influential: the S&P 500 and the Dow Jones Industrial Average. These indexes serve as key indicators of market trends and investor sentiment, making them essential tools for both traders and investors. This article delves into the details of these two major stock indexes, exploring their composition, history, and significance in the US stock market.

The S&P 500: A Benchmark for Large-Cap Stocks

The S&P 500, or Standard & Poor's 500, is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies represent a wide range of industries and sectors, making the S&P 500 a comprehensive measure of the overall health of the US stock market.

Composition: The S&P 500 includes companies from various sectors, such as technology, healthcare, finance, and consumer goods. The index is designed to provide a balanced representation of the US stock market, focusing on large-cap stocks with a market capitalization of at least $8.2 billion.

History: The S&P 500 was first introduced in 1957 and has since become one of the most widely followed stock indexes in the world. Over the years, the index has undergone several changes to ensure it remains representative of the US stock market.

Significance: The S&P 500 is often used as a benchmark for the performance of the US stock market. Investors and traders use it to gauge market trends and make informed investment decisions. Additionally, the index is a key component of many popular exchange-traded funds (ETFs) and mutual funds.

The Dow Jones Industrial Average: A Historical Perspective

The Dow Jones Industrial Average, or simply the Dow, is an index that tracks the performance of 30 large, publicly-owned companies in the United States. These companies are selected based on their historical significance and market capitalization.

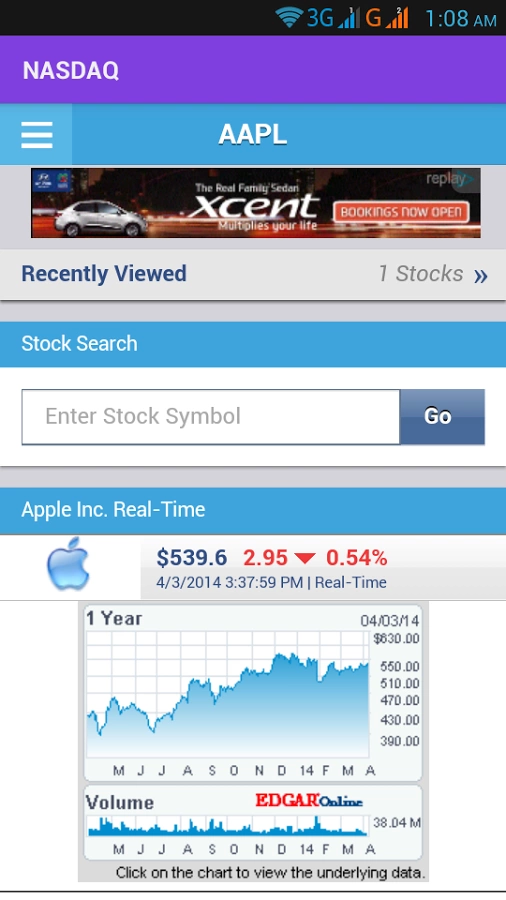

Composition: The Dow includes companies from various sectors, such as technology, healthcare, and consumer goods. Notable companies in the Dow include Apple, Microsoft, and Visa.

History: The Dow was first introduced in 1896 and is one of the oldest stock indexes in the world. It has played a significant role in shaping the US stock market and has been a key indicator of market trends for over a century.

Significance: The Dow is often considered a bellwether for the US stock market. Its performance is closely watched by investors and traders, as it can provide insights into market sentiment and economic conditions.

Comparing the S&P 500 and the Dow Jones Industrial Average

While both the S&P 500 and the Dow Jones Industrial Average are influential stock indexes, there are some key differences between them.

Composition: The S&P 500 includes 500 companies, while the Dow consists of only 30 companies. This difference in composition can lead to variations in performance and market representation.

Weighting: The S&P 500 is a market-cap-weighted index, meaning that the weight of each company in the index is determined by its market capitalization. In contrast, the Dow is a price-weighted index, meaning that the weight of each company is determined by its stock price.

Volatility: The S&P 500 is generally considered to be a more volatile index than the Dow, as it includes a larger number of companies from various sectors.

Conclusion

The S&P 500 and the Dow Jones Industrial Average are two of the most important stock indexes in the United States. They provide valuable insights into market trends and investor sentiment, making them essential tools for traders and investors. By understanding the composition, history, and significance of these indexes, investors can make more informed decisions and better navigate the US stock market.

us stock market today