Maximizing Profits with NYSE Silver: A Comprehensive Guide

author:US stockS -

In the world of investing, precious metals like silver have always been a popular choice for diversification and wealth preservation. The New York Stock Exchange (NYSE) offers investors a unique opportunity to trade silver through its silver futures contracts. In this article, we will delve into the ins and outs of NYSE silver, providing you with the knowledge you need to make informed decisions and maximize your profits.

Understanding NYSE Silver

Firstly, it’s important to understand what NYSE silver represents. The NYSE silver futures contract is a standardized agreement between two parties to buy or sell a specified amount of silver at a predetermined price on a future date. This contract is based on the price of silver on the COMEX division of the NYSE, which is a leading market for precious metal trading.

Key Benefits of Trading NYSE Silver

Diversification: Investing in NYSE silver allows you to diversify your portfolio, reducing the risk associated with a single asset. Historically, silver has had a low correlation with other financial assets, making it an excellent hedge against market volatility.

Liquidity: The NYSE is one of the largest and most liquid exchanges in the world, ensuring that you can enter and exit positions with ease. This liquidity makes silver futures contracts a great choice for both beginners and experienced traders.

Accessibility: Trading NYSE silver is accessible to individuals with varying levels of investment capital. You can start with a small amount of capital and scale up as you gain experience and confidence.

Strategies for Trading NYSE Silver

Technical Analysis: Technical analysis involves studying past price movements to predict future market behavior. Traders use various tools and indicators, such as moving averages, support/resistance levels, and candlestick patterns, to identify potential trading opportunities.

Fundamental Analysis: Fundamental analysis involves evaluating economic, social, and political factors that can impact the price of silver. Traders consider factors like supply and demand, inflation rates, and geopolitical events to make informed decisions.

Hedging: If you already own physical silver or have a significant exposure to the metal, trading NYSE silver can help you hedge against potential price fluctuations.

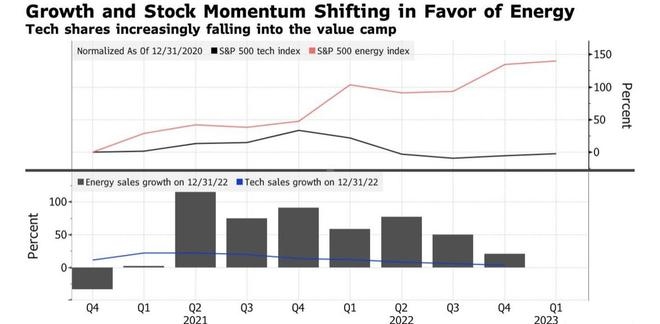

Case Study: Silver Investing During the Pandemic

One notable example of silver’s performance is during the COVID-19 pandemic. As the global economy experienced unprecedented volatility, investors turned to silver as a safe haven. The price of silver surged significantly during this period, offering traders substantial profit opportunities.

Tips for Success

Educate Yourself: Before jumping into the silver market, ensure you have a solid understanding of the factors that influence silver prices and the strategies for trading.

Risk Management: Always use proper risk management techniques, such as setting stop-loss orders and limiting your exposure to a percentage of your overall portfolio.

Stay Informed: Keep up-to-date with market news and economic indicators that can impact silver prices.

In conclusion, NYSE silver presents a unique opportunity for investors to diversify their portfolios and potentially maximize profits. By understanding the market dynamics, implementing effective strategies, and staying informed, you can navigate the silver market with confidence.

us flag stock