1 Year Expectations: Large US Stocks on the Rise

author:US stockS -

As we embark on a new year, investors are eagerly anticipating the performance of large US stocks. The year 2024 is shaping up to be a pivotal one for the stock market, with many experts predicting significant growth for the largest companies in the United States. In this article, we'll delve into the expectations for large US stocks over the next year, analyzing key factors that could influence their performance.

Market Trends and Economic Indicators

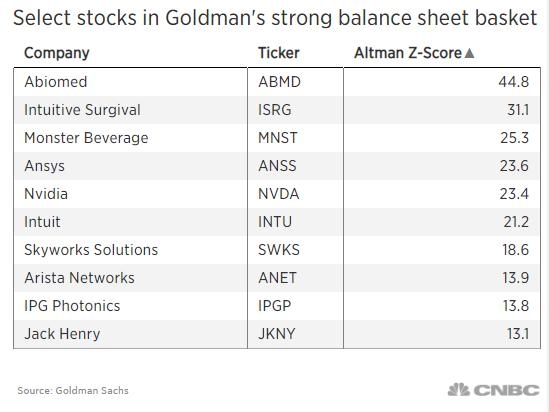

One of the primary factors influencing the expectations for large US stocks is the current state of the economy. With low unemployment rates and strong economic growth, many experts believe that these companies are well-positioned to thrive. The Federal Reserve's monetary policy, including interest rate decisions, is also a crucial factor. While higher interest rates can put pressure on stocks, many large US companies have strong balance sheets and the ability to weather these changes.

Sector Performance

When looking at large US stocks, it's important to consider the performance of different sectors. Technology, healthcare, and consumer discretionary sectors are often seen as key drivers of growth. Companies like Apple, Microsoft, and Amazon have dominated the technology sector, while healthcare giants like Johnson & Johnson and Pfizer are expected to continue their upward trajectory. The consumer discretionary sector, which includes companies like Disney and Nike, is also expected to perform well as consumer confidence remains strong.

Case Studies

To illustrate the potential growth of large US stocks, let's take a look at a few case studies. Apple has been a consistent performer over the years, with its shares experiencing significant growth despite facing challenges such as supply chain disruptions and increased competition. Microsoft has also seen strong growth, particularly in its cloud computing business, with Azure continuing to gain market share. In the healthcare sector, Johnson & Johnson has been a reliable performer, with its diverse product portfolio and strong global presence.

Investment Strategies

For investors looking to capitalize on the expected growth of large US stocks, there are several strategies to consider. Dividend reinvestment can be an effective way to compound returns over time. Index funds and ETFs that track large US stocks can also provide exposure to the market without the need for individual stock picking. Additionally, diversification across different sectors and companies can help mitigate risk.

Conclusion

In conclusion, the expectations for large US stocks in 2024 are optimistic, with many experts predicting significant growth. Factors such as economic indicators, sector performance, and individual company strengths will all play a role in determining the market's trajectory. As investors, it's important to stay informed and consider a variety of strategies to maximize returns.

us flag stock