Unlocking the Power of Investing: A Comprehensive Guide

author:US stockS -

Investing is a critical component of financial planning and can be the key to achieving long-term wealth. Whether you're a seasoned investor or just starting out, understanding the basics of investing is essential. This article will delve into the world of investing, covering the fundamentals, strategies, and key considerations to help you make informed decisions.

Understanding the Basics of Investing

Investing involves allocating money with the expectation of generating an income or profit. There are various types of investments, including stocks, bonds, real estate, and mutual funds. Each has its own set of risks and rewards, making it crucial to understand the basics before diving in.

Stocks: Ownership in a Company

Stocks represent ownership in a company. When you buy stocks, you become a shareholder and have a claim on the company's assets and earnings. The value of stocks can fluctuate based on the company's performance and market conditions.

Bonds: Lending Money to a Company or Government

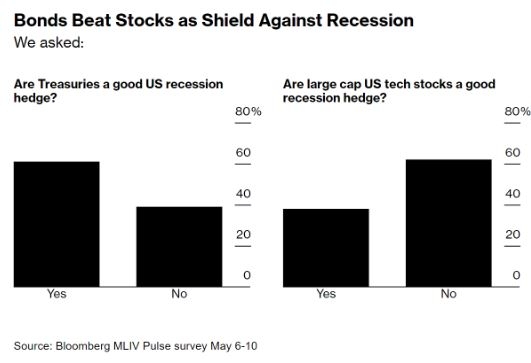

Bonds are debt instruments that allow investors to lend money to a company or government. In return, the issuer pays interest on the loan at regular intervals. Bonds are generally considered less risky than stocks but offer lower potential returns.

Real Estate: Investing in Property

Real estate investing involves purchasing property to generate income or capital appreciation. This can include residential, commercial, or industrial properties. Real estate investments can provide steady cash flow and the potential for long-term growth.

Mutual Funds: Diversified Investment Portfolios

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This allows individual investors to access a wide range of investments without having to manage them individually.

Strategies for Successful Investing

To succeed in investing, it's essential to develop a well-thought-out strategy. Here are some key strategies to consider:

Diversification: Diversifying your investments across different asset classes can help reduce risk and maximize returns. This means investing in a mix of stocks, bonds, and real estate, as well as other assets like commodities and currencies.

Risk Management: Understanding your risk tolerance is crucial when investing. Different investments carry varying levels of risk, so it's important to choose investments that align with your risk tolerance and investment goals.

Long-Term Perspective: Investing is a long-term endeavor. Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on your long-term investment goals and stick to your strategy.

Regular Contributions: Consistently contributing to your investments can help you benefit from the power of compounding. Even small contributions can grow significantly over time.

Case Study: The Benefits of Diversification

Consider the case of John, a 30-year-old investor who decided to diversify his portfolio. He invested 50% of his money in stocks, 30% in bonds, and 20% in real estate. Over the next 10 years, the stock market experienced significant volatility, but John's diversified portfolio protected him from significant losses. His bond investments provided a stable income, while his real estate investments appreciated in value.

Conclusion

Investing is a powerful tool for achieving financial goals. By understanding the basics, developing a well-thought-out strategy, and staying committed to your plan, you can unlock the power of investing and build long-term wealth. Remember to diversify, manage risk, and maintain a long-term perspective to maximize your chances of success.

new york stock exchange