How to Invest in US Stocks: A Comprehensive Guide

author:US stockS -

Are you interested in investing in US stocks but unsure where to start? Investing in the US stock market can be a lucrative opportunity, but it requires knowledge and strategy. In this article, we will provide you with a comprehensive guide on how to invest in US stocks, including the types of stocks, the best platforms for investing, and tips for successful investing.

Understanding the Types of Stocks

Before diving into the world of US stocks, it's essential to understand the different types of stocks available. Here are the primary categories:

- Common Stocks: These represent ownership in a company and typically come with voting rights. Common stocks are subject to higher risk but offer the potential for higher returns.

- Preferred Stocks: These stocks have a fixed dividend and typically offer priority over common stocks in the event of bankruptcy. However, preferred stockholders usually do not have voting rights.

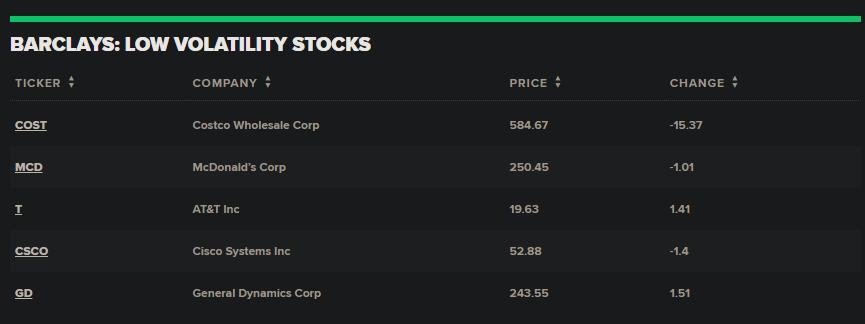

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a long history of profitability. Blue-chip stocks are considered lower risk but may offer lower returns compared to other types of stocks.

- Growth Stocks: These stocks are from companies with high growth potential. Investors looking for long-term capital appreciation often invest in growth stocks.

Choosing the Right Platform for Investing

When it comes to investing in US stocks, you have several options for platforms. Here are some popular choices:

- Brokerage Firms: These firms offer a variety of investment services, including stock trading, research, and financial advice. Some well-known brokerage firms include Fidelity, Charles Schwab, and TD Ameritrade.

- Robo-Advisors: These are automated investment platforms that use algorithms to manage your investments. Robo-advisors are great for beginners and those looking for a low-cost investment option. Some popular robo-advisors include Betterment, Wealthfront, and Vanguard Personal Advisor Services.

- Online Brokerage Platforms: These platforms offer a user-friendly interface for buying and selling stocks. Examples include E*TRADE, Robinhood, and Webull.

Tips for Successful Investing

To maximize your chances of success in the US stock market, consider the following tips:

- Do Your Research: Before investing, research the company and its industry. Look for companies with strong financials, a solid business model, and a competitive advantage.

- Diversify Your Portfolio: Diversification helps reduce risk by spreading your investments across different sectors and asset classes.

- Set Realistic Goals: Determine your investment goals, risk tolerance, and time horizon. This will help you make informed decisions and avoid making impulsive investments.

- Stay Informed: Keep up with market news and trends to stay informed about potential opportunities and risks.

- Avoid Emotional Investing: Don't let your emotions drive your investment decisions. Stick to your plan and avoid making impulsive moves based on short-term market fluctuations.

Case Study: Apple Inc.

Let's take a look at a real-world example of investing in a US stock. Apple Inc. (AAPL) is a well-known technology company that has been a popular investment choice for many years.

In 2010, Apple's stock price was around

By understanding the company's business model, market position, and financials, investors were able to identify the potential for long-term growth and capitalize on the stock's rise.

Conclusion

Investing in US stocks can be a rewarding experience, but it requires knowledge, research, and discipline. By understanding the types of stocks, choosing the right platform, and following these tips, you can increase your chances of success in the US stock market. Remember to stay informed, diversify your portfolio, and avoid emotional investing. Happy investing!

new york stock exchange