Understanding the US $500 Stock Price: A Comprehensive Guide

author:US stockS -

In the dynamic world of stock markets, the

What Does a $500 Stock Price Mean?

A

Market Capitalization: A $500 stock price suggests that the company has a high market capitalization. Market capitalization is the total value of all the company's shares of stock. Companies with high market caps are typically well-established and have a strong presence in their industry.

Performance: A stock priced at $500 is likely to have performed well over time. This indicates a level of stability and profitability that can be attractive to investors.

Valuation: The $500 stock price could also suggest that the stock is overvalued or undervalued. It's essential to conduct thorough research to determine the stock's true value.

Determining the $500 Stock Price

Several factors contribute to a stock's price, including:

Company Performance: The financial health of the company, including its revenue, earnings, and growth prospects, plays a significant role in determining its stock price.

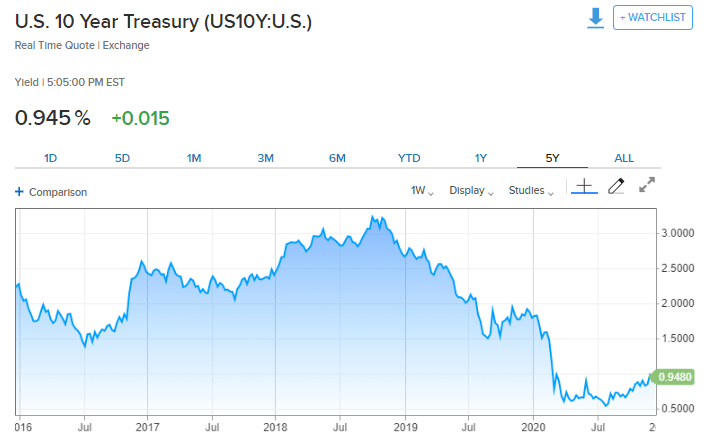

Market Conditions: The overall state of the stock market can impact individual stock prices. Factors like interest rates, economic indicators, and geopolitical events can influence market sentiment.

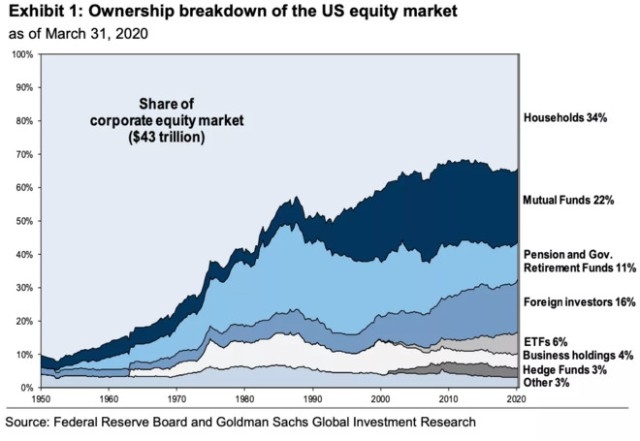

Supply and Demand: The number of shares available in the market (supply) and the demand for those shares (demand) also influence stock prices.

Case Study: Apple Inc.

A prime example of a stock with a

Investment Implications

Investing in a $500 stock requires careful consideration. Here are some key points to keep in mind:

Risk: High-priced stocks can be riskier, as they may experience more significant price fluctuations.

Dividends: Companies with high stock prices may offer lower dividend yields. This means investors may receive less income from their investments.

Long-Term Growth: High-priced stocks can offer significant long-term growth potential, but they may take longer to appreciate in value.

In conclusion, a $500 stock price is a significant indicator of a company's value, performance, and market position. Understanding the factors that influence this price point is crucial for making informed investment decisions. As always, it's essential to conduct thorough research and consider your risk tolerance before investing in high-priced stocks.

newsbreak stock