Duo US Stock: Your Ultimate Guide to Diversifying Your Portfolio

author:US stockS -

Are you looking to expand your investment portfolio with U.S. stocks? If so, you've come to the right place. In this comprehensive guide, we'll explore the world of Duo US Stock, providing you with valuable insights and strategies to diversify your investments effectively.

Understanding Duo US Stock

What is Duo US Stock?

Duo US Stock refers to a strategy where investors purchase shares from two or more U.S.-based companies across various industries. This approach helps in spreading risk and maximizing returns by investing in different sectors that may perform differently under various economic conditions.

Benefits of Duo US Stock

- Risk Diversification: By investing in multiple stocks, you reduce the risk associated with a single company's performance.

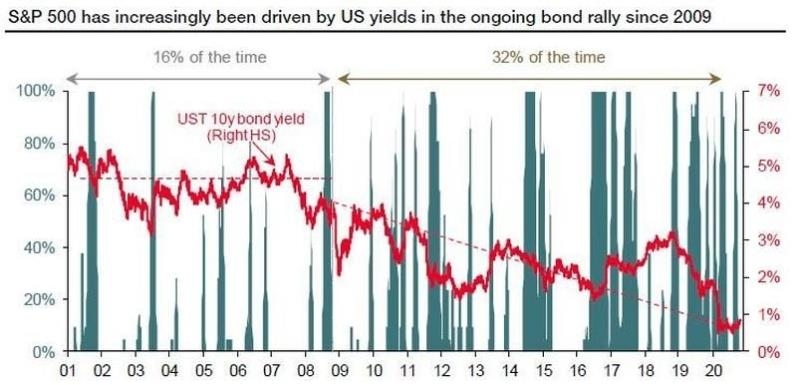

- Potential for Higher Returns: Investing in diverse sectors can lead to higher returns, as one sector's underperformance may be offset by another's strong performance.

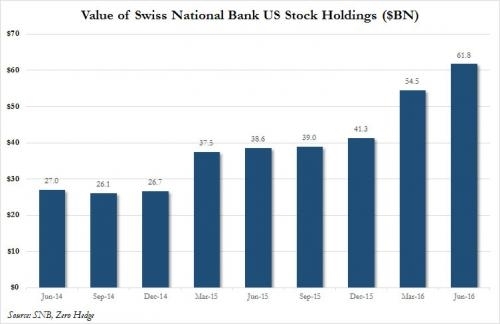

- Market Exposure: Duo US Stock allows you to gain exposure to various industries, such as technology, healthcare, finance, and consumer goods.

How to Get Started with Duo US Stock

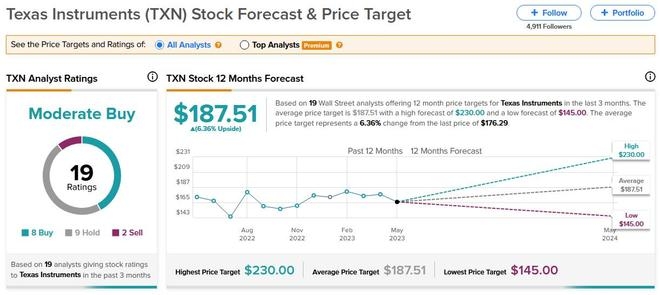

- Research and Select Companies: Identify companies with strong fundamentals, a solid track record, and potential for growth.

- Diversify Across Industries: Invest in companies from different sectors to mitigate risks.

- Monitor Your Portfolio: Regularly review your investments to ensure they align with your investment goals and risk tolerance.

Top Duo US Stock Picks

- Apple Inc. (AAPL): A leading technology company with a strong presence in the smartphone, computer, and services markets.

- Microsoft Corporation (MSFT): A dominant player in the software industry, offering products like Windows, Office, and Azure cloud services.

- Amazon.com, Inc. (AMZN): A global e-commerce giant with a diverse portfolio of products and services, including cloud computing, streaming, and logistics.

Case Study: Duo US Stock Success Story

Let's consider a hypothetical scenario where an investor decides to invest in a duo of companies - Apple Inc. and Microsoft Corporation. Over the past five years, both companies have delivered impressive returns, with Apple's stock increasing by 70% and Microsoft's stock rising by 50%.

By diversifying their portfolio with these two top-performing companies, the investor managed to achieve a balanced return, despite market fluctuations.

Conclusion

Investing in Duo US Stock can be a smart strategy for diversifying your portfolio and maximizing returns. By carefully selecting companies from different sectors and regularly monitoring your investments, you can navigate the volatile stock market with confidence.

Remember, it's essential to do thorough research and consult with a financial advisor before making any investment decisions. Happy investing!

newsbreak stock