US or International Stocks: Which is Right for You?

author:US stockS -In the ever-evolving world of investing, the question of whether to invest in U.S. stocks or international stocks is a common dilemma. Both offer unique opportunities and risks, and the decision largely depends on your investment goals, risk tolerance, and market knowledge. This article delves into the key factors to consider when deciding between U.S. and international stocks.

Understanding U.S. Stocks

U.S. stocks represent shares of publicly traded companies based in the United States. These companies are subject to stringent regulations and are typically more established and stable. The U.S. stock market, particularly the S&P 500, is often considered a benchmark for global stock market performance.

Advantages of U.S. Stocks:

- Regulatory Oversight: U.S. companies are subject to strict regulations, ensuring transparency and accountability.

- Diverse Industries: The U.S. stock market offers exposure to a wide range of industries, including technology, healthcare, finance, and consumer goods.

- Economic Stability: The U.S. economy is generally considered to be one of the most stable in the world, offering investors a sense of security.

Understanding International Stocks

International stocks, on the other hand, represent shares of companies based outside the United States. Investing in international stocks can provide exposure to emerging markets, diverse currencies, and unique industries.

Advantages of International Stocks:

- Emerging Markets: Investing in emerging markets can offer higher growth potential compared to developed markets.

- Diversification: International stocks can help diversify your portfolio, reducing exposure to U.S. market fluctuations.

- Unique Opportunities: Investing in international stocks can provide access to unique industries and products that may not be available in the U.S.

Factors to Consider When Choosing Between U.S. and International Stocks:

- Investment Goals: Determine your investment goals, such as capital appreciation, income generation, or diversification.

- Risk Tolerance: Assess your risk tolerance and choose investments that align with your comfort level.

- Market Knowledge: Gain a thorough understanding of both the U.S. and international markets to make informed decisions.

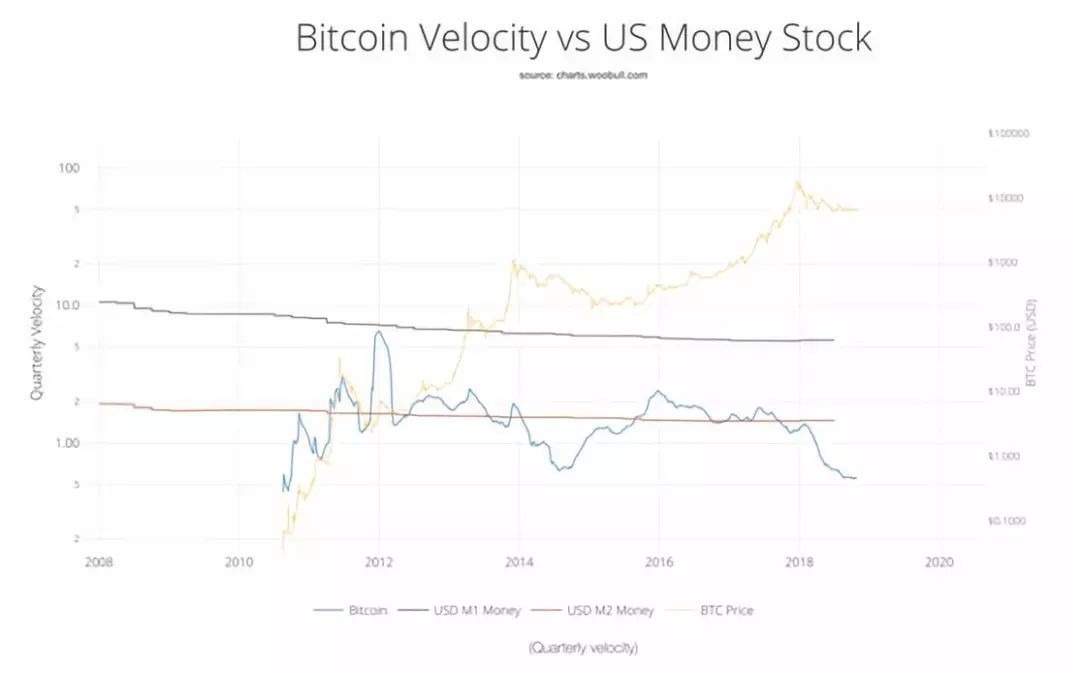

- Economic Factors: Consider economic factors such as interest rates, inflation, and political stability when choosing between U.S. and international stocks.

Case Studies:

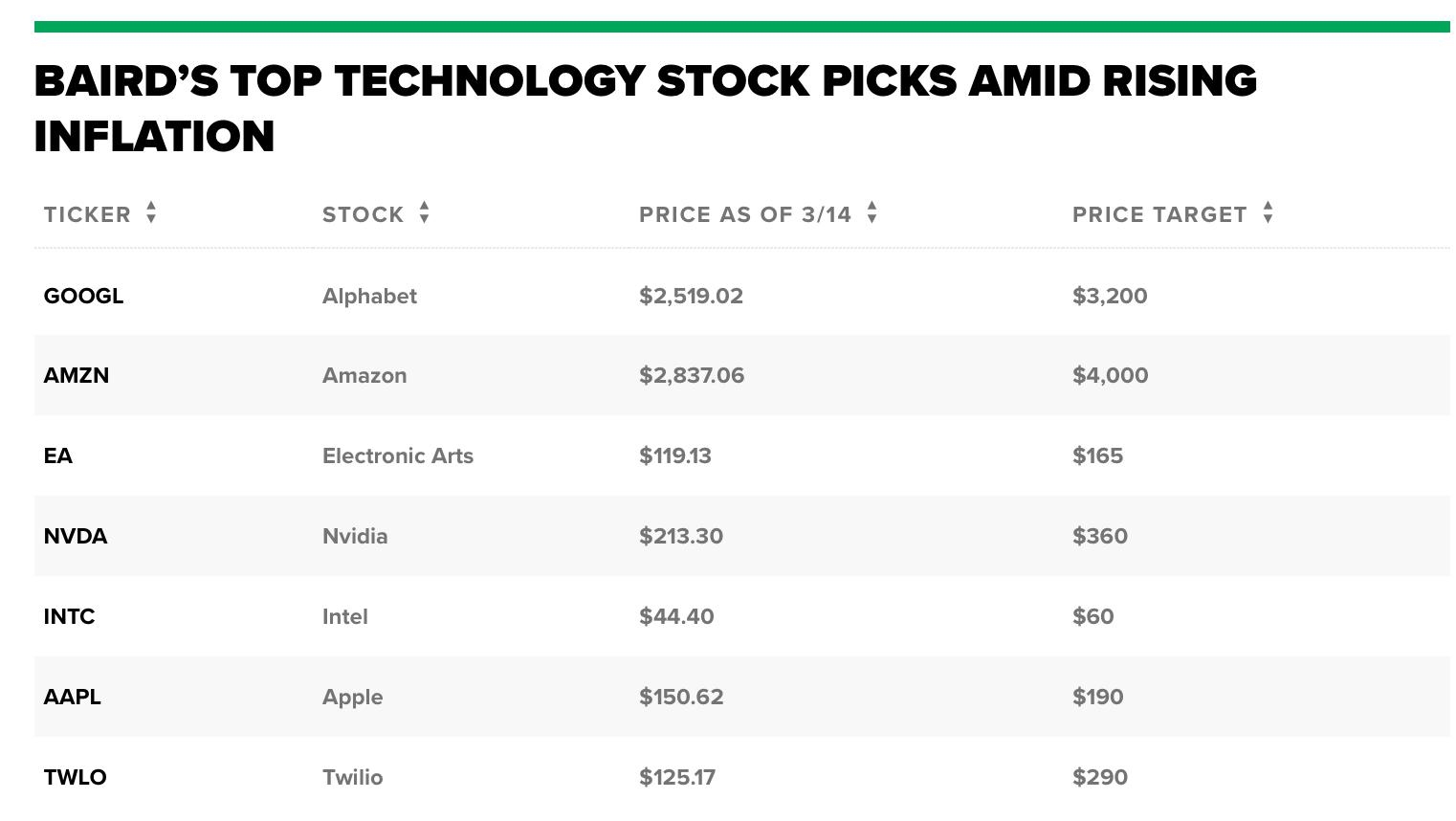

- Apple Inc. (U.S. Stock): Apple is a prime example of a successful U.S. stock. Its shares have seen significant growth over the years, making it a popular choice for investors seeking capital appreciation.

- Nestlé SA (International Stock): Nestlé, a Swiss-based company, offers exposure to the consumer goods industry in emerging markets. Its shares have provided investors with both capital appreciation and dividends.

In conclusion, the decision between U.S. and international stocks depends on your individual investment goals, risk tolerance, and market knowledge. Both options offer unique opportunities and risks, and it is crucial to carefully consider these factors before making a decision.

us flag stock