Tencent Holdings Ltd Stock US: A Comprehensive Analysis

author:US stockS -Tencent(1)Com(6)Holdings(1)Stock(145)LTD(1)

In the ever-evolving world of technology, Tencent Holdings Ltd (TCEHY) has emerged as a dominant force in the global market. As an investor looking to diversify your portfolio, understanding the intricacies of Tencent's stock, particularly its US listing, is crucial. This article delves into the key aspects of Tencent Holdings Ltd Stock US, providing you with a comprehensive analysis to make informed investment decisions.

Tencent Holdings Ltd: An Overview

Tencent Holdings Ltd is a Chinese multinational conglomerate that operates in various sectors, including social media, gaming, e-commerce, and entertainment. The company's most popular platforms include WeChat, QQ, and the popular gaming platform, Tencent Games. With a market capitalization of over $500 billion, Tencent is one of the largest companies in the world.

US Listing of Tencent Holdings Ltd

Tencent Holdings Ltd stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol TCEHY. This listing allows investors worldwide to access and invest in the company's stock. The US listing has been a significant factor in the growth and success of Tencent, as it provides exposure to a broader market and attracts international investors.

Key Factors Affecting Tencent Holdings Ltd Stock US

Revenue Growth: Tencent has shown impressive revenue growth over the years, driven primarily by its social media and gaming platforms. However, it's important to analyze the sustainability of this growth and the potential impact of market saturation in certain segments.

Market Competition: Tencent faces intense competition from other major players in the tech industry, such as Alibaba and Baidu. Understanding the competitive landscape and the company's strategies to maintain its market position is crucial for investors.

Regulatory Changes: Tencent operates in a highly regulated industry, particularly in China. Changes in regulations can have a significant impact on the company's operations and profitability. Monitoring regulatory developments is essential for investors.

Global Economic Factors: Tencent is exposed to global economic factors, such as trade tensions and currency fluctuations. These factors can influence the company's financial performance and investment attractiveness.

Tencent Holdings Ltd Stock US: Performance Analysis

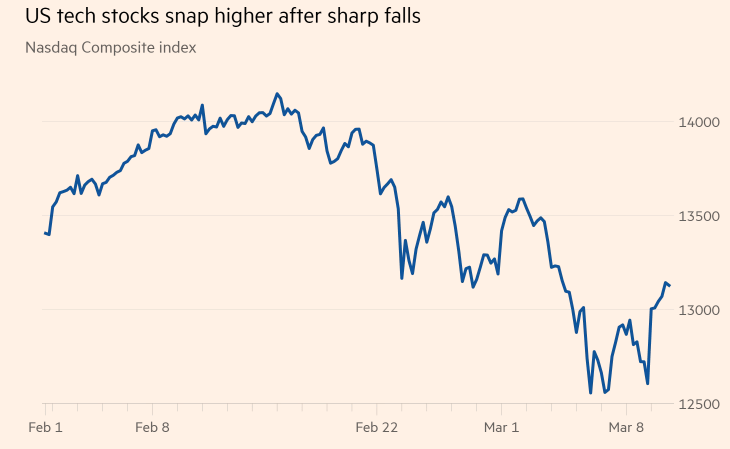

Over the past few years, Tencent Holdings Ltd Stock US has experienced fluctuations in its share price. While the stock has shown significant growth in some periods, it has also faced challenges, particularly during the global pandemic. Analyzing historical performance can provide insights into the company's resilience and potential for future growth.

Case Studies: Tencent's Acquisition Strategy

One of the key factors contributing to Tencent's success is its strategic acquisition strategy. The company has made several high-profile acquisitions, such as the purchase of a majority stake in Supercell and a minority stake in Epic Games. These acquisitions have helped Tencent diversify its portfolio and strengthen its position in the global gaming industry.

Conclusion

In conclusion, Tencent Holdings Ltd Stock US presents a unique opportunity for investors seeking exposure to the rapidly growing tech industry. By understanding the key factors affecting the stock and analyzing the company's performance, investors can make informed decisions. However, it's important to keep a close eye on regulatory changes and global economic factors that can impact the company's operations and profitability.

new york stock exchange