Best US Bond Stocks: Top Picks for Secure Investments

author:US stockS -Stocks(89)Best(25)Top(28)Picks(6)for(16)Bond(1)

In the ever-evolving financial market, investors are constantly seeking opportunities for secure and profitable investments. One such avenue is through U.S. bond stocks. These investments offer stability and predictable returns, making them a popular choice among conservative investors. In this article, we'll explore the best U.S. bond stocks and provide insights into why they are considered secure investments.

Understanding U.S. Bond Stocks

Before delving into the top picks, it's essential to understand what U.S. bond stocks are. These stocks represent ownership in a company that has issued bonds. When a company issues bonds, it borrows money from investors, who become bondholders. In return, the company agrees to pay interest on the borrowed funds at regular intervals and repay the principal amount upon maturity.

Benefits of Investing in U.S. Bond Stocks

Investing in U.S. bond stocks offers several advantages:

- Stability: U.S. bond stocks are generally considered to be low-risk investments, providing stability in your portfolio.

- Predictable Returns: As bondholders, you receive fixed interest payments at regular intervals, offering a predictable source of income.

- Diversification: Including U.S. bond stocks in your portfolio can help diversify your investments, reducing the overall risk.

Top U.S. Bond Stocks to Consider

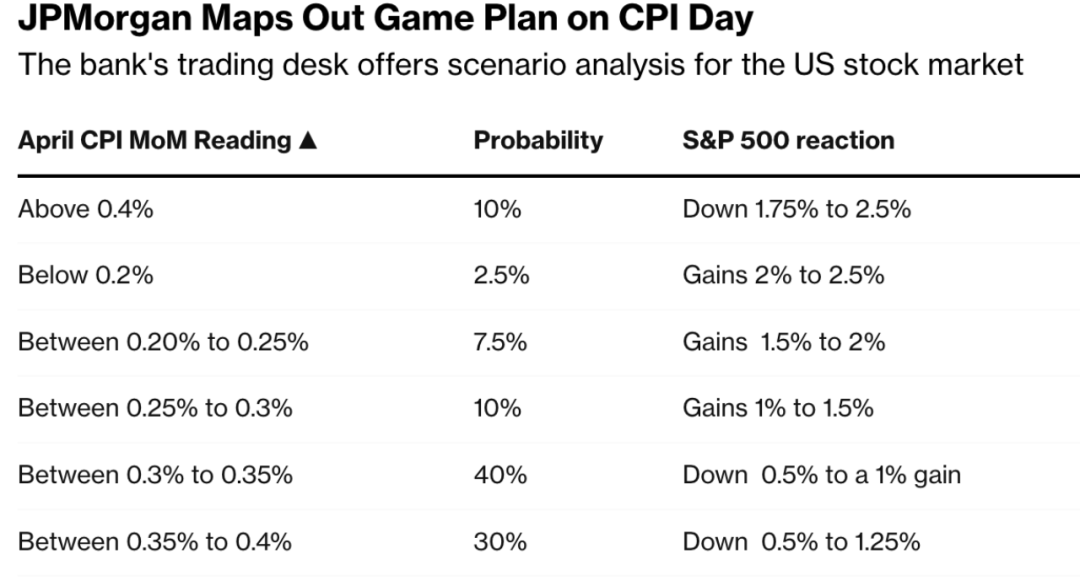

- JPMorgan Chase & Co. (JPM)

JPMorgan Chase is one of the largest financial institutions in the U.S. With a strong credit rating and a history of stability, it is a top pick for U.S. bond stocks. The company offers various bond products, including corporate bonds and mortgage-backed securities.

- Bank of America Corporation (BAC)

Bank of America is another leading financial institution with a solid credit rating. The bank offers a range of bond products, making it an attractive option for investors seeking stable returns.

- Apple Inc. (AAPL)

While Apple is primarily known for its consumer electronics, the company has also ventured into the bond market. With a strong credit rating and a diverse product portfolio, Apple's bond stocks provide a secure investment option.

- Microsoft Corporation (MSFT)

Microsoft is a technology giant with a solid financial position. The company has issued bonds to fund its operations and expansion, making it an attractive investment for those seeking stability and predictable returns.

- Procter & Gamble Co. (PG)

Procter & Gamble is a consumer goods giant with a strong credit rating. The company's bond stocks offer stability and predictable returns, making it a popular choice among conservative investors.

Case Study: Microsoft Corporation

To illustrate the potential of U.S. bond stocks, let's consider Microsoft Corporation. In 2020, Microsoft issued $15 billion in bonds to fund its operations and expansion. The bonds carried a yield of around 1.25%, offering a predictable source of income for investors. As of 2023, the bonds have matured, and investors received their principal amount back, along with the interest payments.

Conclusion

U.S. bond stocks are an excellent investment option for those seeking stability and predictable returns. By understanding the benefits and risks associated with these investments, you can make informed decisions and diversify your portfolio effectively. As always, it's crucial to consult with a financial advisor before making any investment decisions.

newsbreak stock